Is Value Investing Dead?? | Value Vs Growth Stocks Study | Buffett Vs Cathie Wood

What is Value Investing?

Value Investing is an investing strategy categorised by two aspects, the first is finding the “Intrinsic Value” of a stock or asset, then the second is aiming to buy below that “intrinsic value”.

There is also “Deep Value investing” which entails buying a stock for below it’s net asset value “net-nets” popularised by the Father of Value Investing Benjamin Graham, Warren Buffett’s former professor, whom wrote the famous book “The Intelligent Investor”.

Value Investing correlates most with traditional business logic. The Idea is simply to “buy cash flows cheaply” or “buy one dollar for 50 cents” as Warren Buffett would say.

“All Investing is Value Investing, who wants to pay more for something than it’s worth” – Charlie Munger (Billionaire Value Investor)

Legendary Value Investor Joel Greenblatt giving an example for why he is a value investor, paraphrasing his quote below:

” If you were buying a house would you buy a house which has recently gone up in price & is thus more expensive (that is momentum investing) or would

you quantify the cash flows from rental income & aim to buy a house which was relatively cheaper than similar ones in the area…that is value investing. “

What is the Value of a Stock?

A stock is just a share of a company, thus the value of the company is present value of the companies future cash flows.

As the old saying goes “A bird in the hand is worth two in the bush”. Thus cash in hand today is more valuable than “promised” cash in the future. This is because of uncertainty/risk to cash flows, in addition to inflation & opportunity cost.

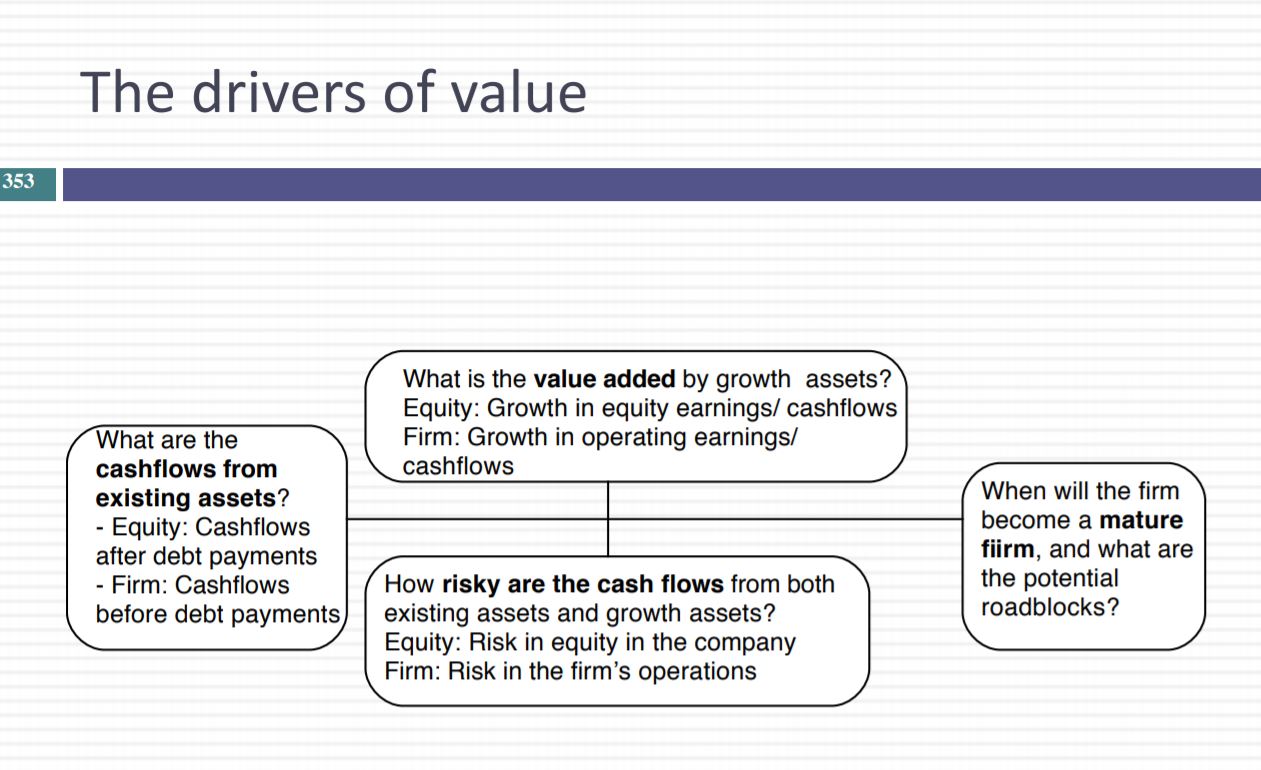

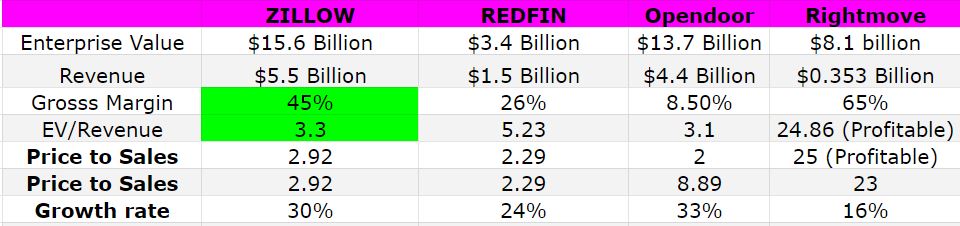

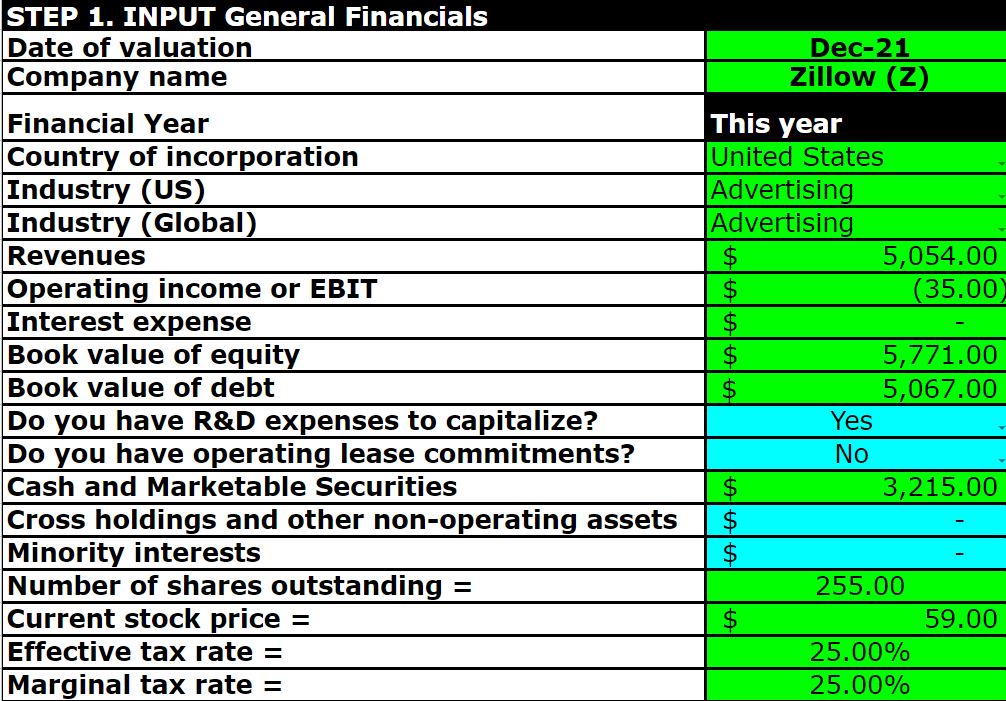

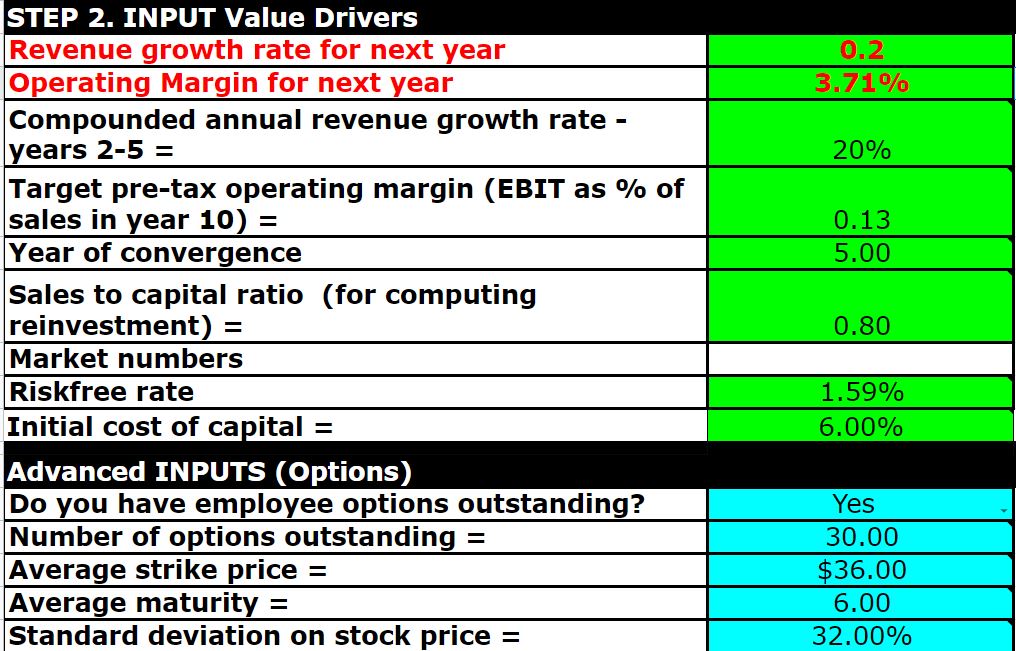

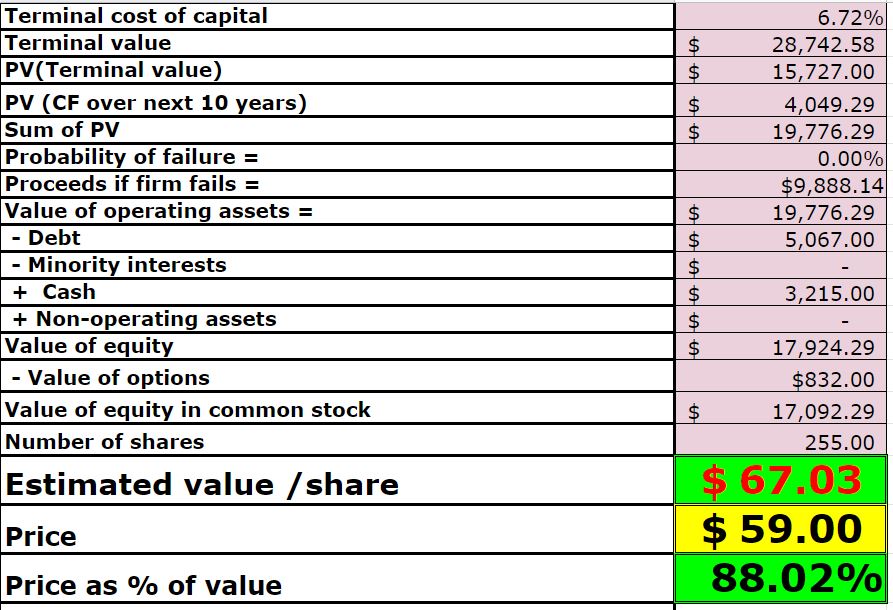

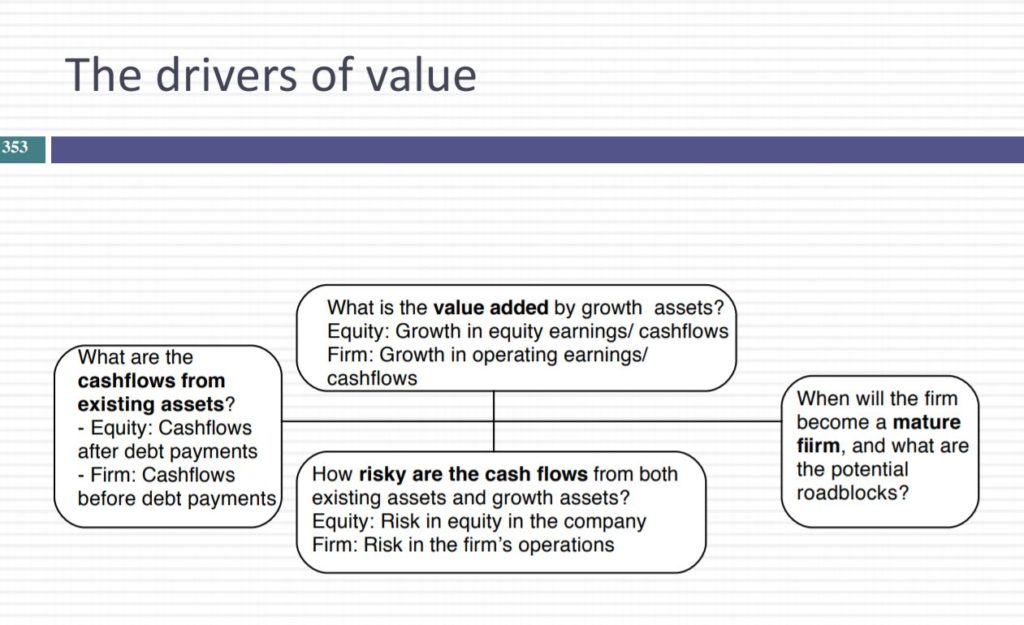

4 Questions to Value a company or Stock. Source: Professor of Finance, New York University

There are three drivers of business value:

- Cash Flows (Existing)

- Growth in Future Cash Flows

- Risk to Cash Flows

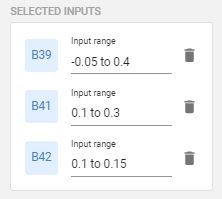

To find out the “present value” of cash for a business we use what is called a “Discounted Cash Flow model” . We have created advanced discounted for over 55+ stocks which you can download as part of our Stock Investing Course.

Value vs Growth Investing?

Value and Growth Stock investing are not as different as many people think…if executed correctly with a solid strategy.

As “Growth in Future Cash Flows” is a portion of value, thus modern Value investors don’t ignore growth as commonly thought. The challenge lies in predicting the “Growth in future cash flows”, this is uncertain as nobody can predict the future consistently.

Thus as a rule of thumb, a value investor may be more inclined to pay less for promised growth in future cash flows and thus focus more on historic and more certain cash flows.

This leads to many traditional value investors having a bias toward more established mature companies as opposed to a young biotech company with lots of future growth priced into the stock.

A Growth Stock investor such as Cathie Wood of Ark Invest (original Tesla Investor) may be more inclined to pay more for future cash flows as she has higher conviction.

Is Value Investing Dead??

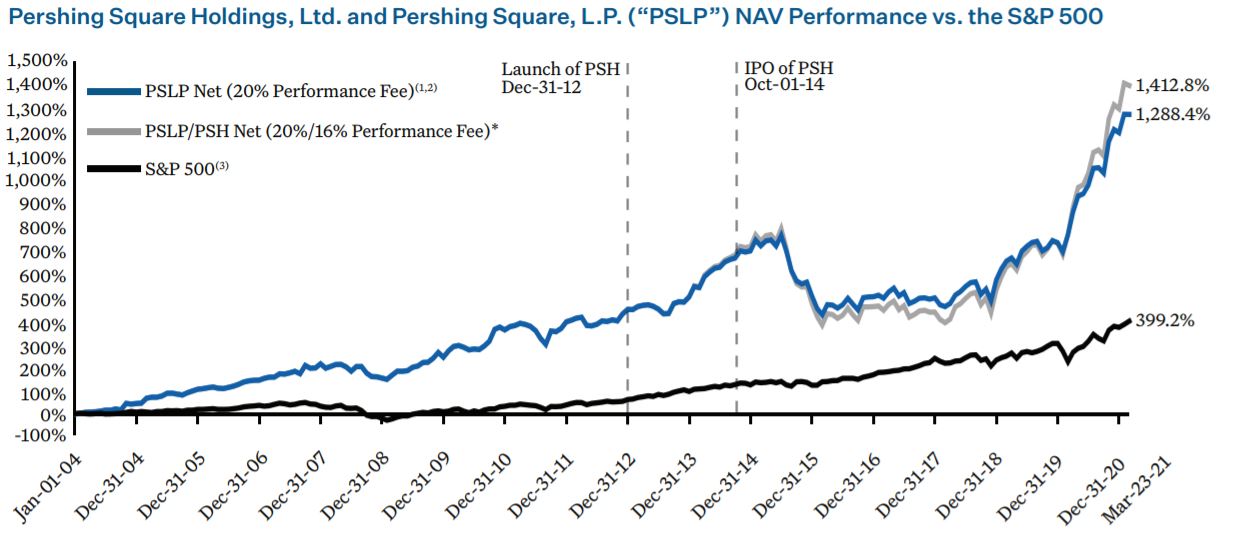

Value investing has UNDERPERFORMED growth stock investing over the past decade which has lead many people to say “Value Investing is dead”. However in 70 years prior Value has OUTPERFORMED growth stock investing strategies.

Thus Value Investing has a greater track record of outperformance historically and as a strategy is as timeless as common sense and thus not dead. The fact that Value has underperformed growth over the past 10 years, has led some people to believe this is a systematic change, only time will tell.

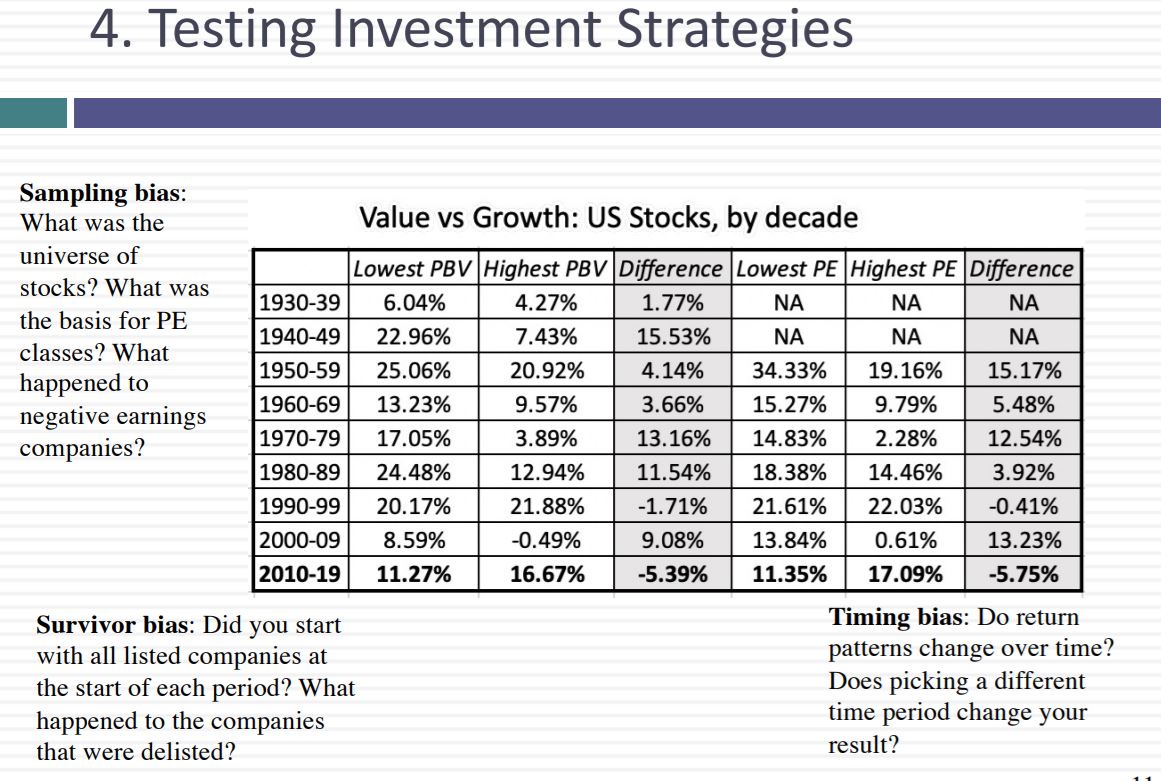

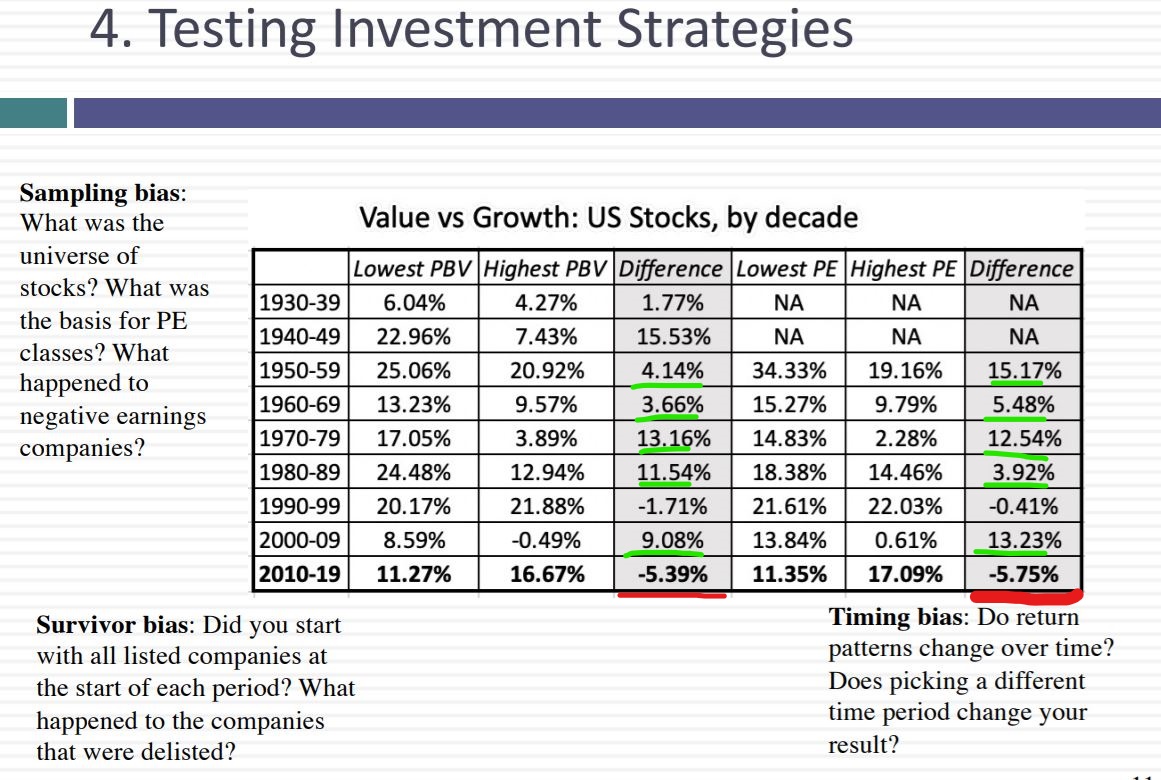

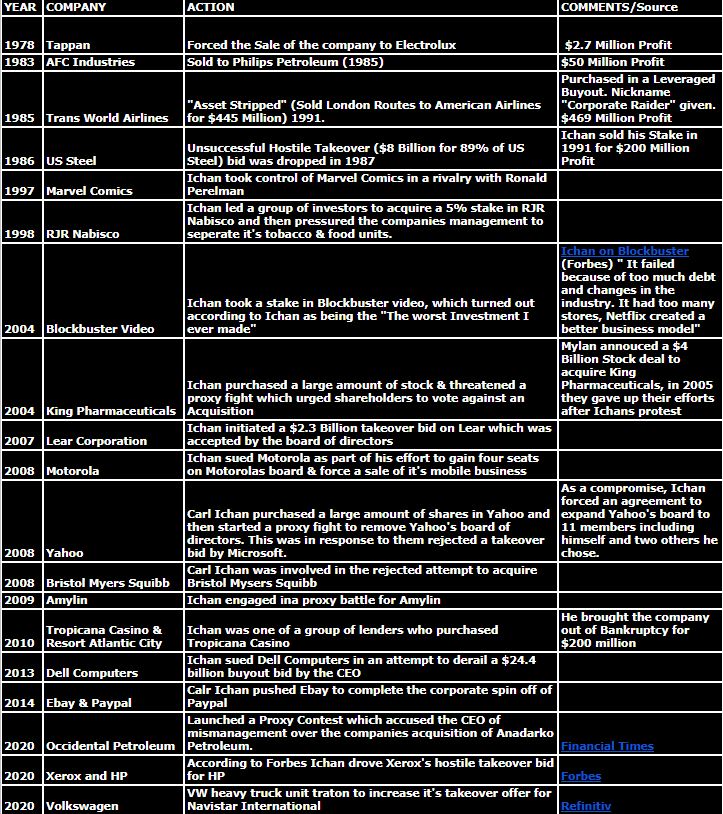

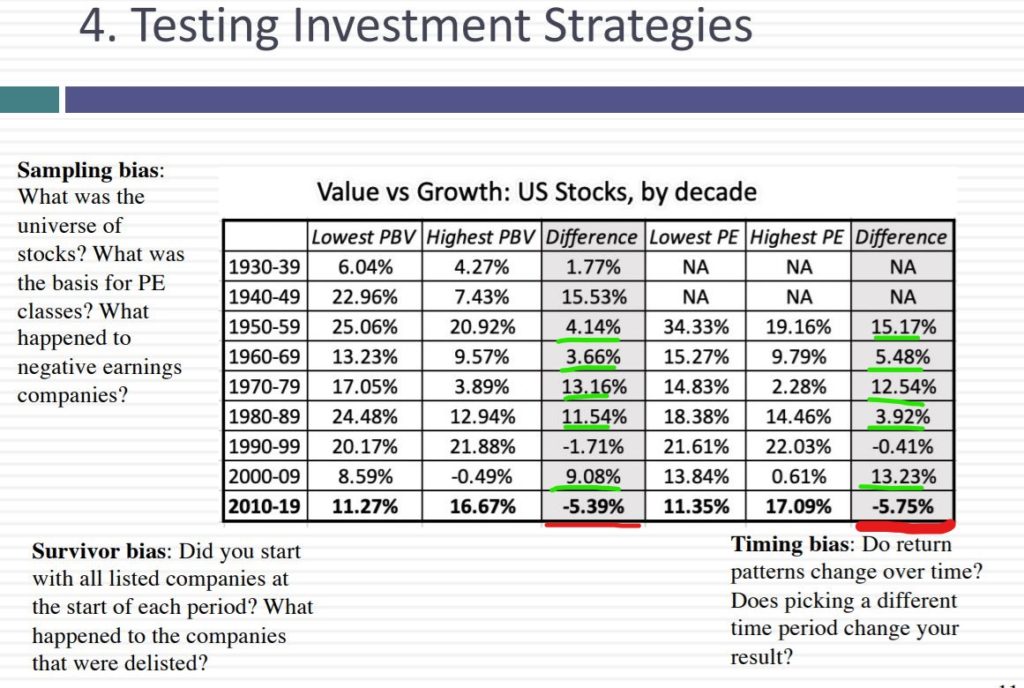

According to a study by a Professor of Valuation at New York University (2020) , a simplified value investing strategy of buying stocks with low Price to Earnings (PE Ratios) and Low Price to Book value (PBV) would have UNDERPERFORMED a simplified growth investing strategy by approximately -5.75% between 2010 and 2019.

However, Historically a Value investing has outperformed growth investing over the 70 years prior.

The exception is the historic period between 1990 to 1999 when both strategies returned close to equal returns +/- 1.7%.

This is from a back-test of four simple strategies, using extremely simplified measures of Value.

- Buy “cheap” Value stocks with a Low Price to Earnings Ratio (PE Ratio) – Simple Value Strategy

- Buy “cheap” Value stocks with a Low Price to Book Value (PBV ) – Simple Value Strategy

- Buy “Expensive” Growth Stocks with a high Price to Earning Ratio (PE Ratio) – Simple Growth Strategy

- Buy “Expensive” Growth Stocks with a high price to book value (PBV) – Simple Growth Strategy

See below image details from study

Investment strategies historically Value vs Growth stocks. Source New York University (Professor of Finance)

From the image above from the study of value vs growth investing, I have highlighted in Green the decades when this simple value investing strategy out performance growth (50 years+) and in red the decade where growth has outperformed value (Last decade).

Warren Buffett Vs Cathie Wood

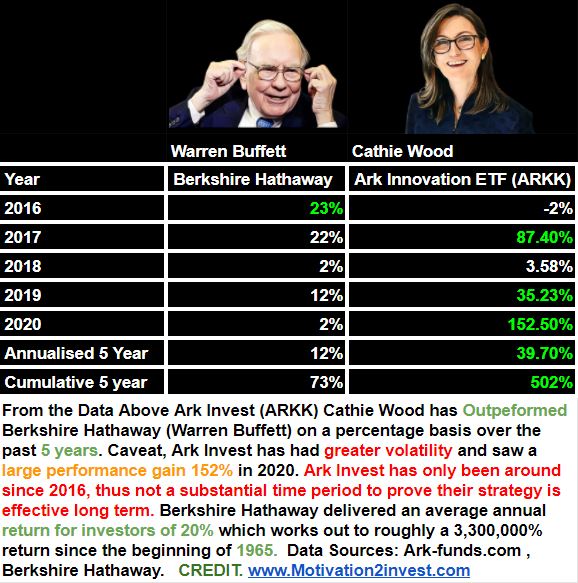

If we take a classic value investor (Warren Buffett) and a famous Growth Stock Investor (Cathie Wood) lets compare investment returns historically.

Ark Invest vs Berkshire Hathaway Returns (Cathie Wood Vs Warren Buffett)(Value Vs Growth Stock Investing. Source: www.motivation2invest.com/value-growth-stocks

From the data above Ark Invest (ARKK) Cathie Wood has outperformed Berkshire Hathaway (Warren Buffett) on a percentage basis over the past 5 years with an annualised return of 39.7% vs 12% for Berkshire Hathaway.

Why Cathie Wood may not be better than Buffett?

1. Ark Invest has limited historic performance data

Ark Invest was founded in 2014 and their official website only shows ARKK data from 2016. This is not a substantial time period to prove their strategy is effective long term, as luck can play a larger factor in such small data sets.

2. Ark Invest had exceptional returns in 2020

Ark Invest has had good returns most years but exceptional returns in 2020 (152%) . Could 2020 have been a year when luck played a large part?

Ark invest has a Year to Date performance for ARKK of just 5% (as of Dec 2021).

Berkshire Hathaway has a Year to Date Performance of 22.5%, greater than Ark Invest!

3. Tesla Stock in 2020

Tesla Stock made up approximately 10% of Ark Invests Innovation ETF in 2020, making it their largest and highest conviction holding.

This stock experiencing astonishing returns up 700%+ in 2020 alone, driving majority of Ark Invests returns in 2020.

The question is has Ark Invest & Cathie Wood chosen many “Tesla Stocks” which will also have tremendous performance in the future.

Cathie Wood Quotes Ark Invest Tesla

Credit: www.Motivation2invest.com/Cathie-Wood

4. Berkshire Hathaway Long term Record

Berkshire Hathaway has returned average annual return for investors of 20% since the beginning of 1965 (over 56 years!) . The total returns to Buffett’s firm since 1965 has been a whopping 2,810,526%!

5. Size of Berkshire Hathaway Vs Ark Invest

The larger a company the more difficult it is for them to grow (on a percentage basis) and also find investment opportunities.

Ark Invest has $42 Billion in assets under management (2021) whereas Berkshire Hathaway has $239 Billion in assets! To put things into perspective Berkshire Hathaway has $149 Billion just in cash on hand, this is enough to buy the entire Ark Invest (and all ETF’s) over 3 times over!

So when comparing Berkshire Hathaway to Ark Invest, it is not comparing apples to apples, but as we care about percentage returns that is what we have done.

Conclusion

Value or Growth Stock Investing are two strategies with a lot in common as predicting the “Growth in Cash Flows” is a portion of valuing a company.

To ignore value is to ignore reality and only makes sense for a short term momentum trader where fundamentals are irrelevant.

From studying the greatest investors of all time, I was not surprised to see that the vast majority identify themselves as “Value Investors” although they have variations in terms of style. From Buffett to Charlie Munger, Michael Burry (Big Short) and many more.

I personally consider myself a combination of both a value & growth investor, some would call me a “modern day value investor”.

I have an open mind to valuing a business and shake off historic rules of thumb from the past.

For example, I believe in embracing new valuation methods (as PE Ratio’s) are not sufficient and “money losing” tech companies may actually be great investments (Amazon, Uber etc) so should be looked at with an open mind.

Good luck on your journey to being a great investor, I wish you wealth & prosperity.

Value vs Growth Investor Quotes Gallery

Want to Learn how to be great investor?

We have compiled together the strategies from the greatest investors of all time with our own real world investing experience to create the ultimate investing strategy course for the fundamental investor.

We open the course & our stock research platform each month for a limited time, so be sure to click through to reserve your spot. Good Luck!