Joel Greenblatt is a legendary Value investor with a net worth of approximately $500 Million. Joel is a classic value investor and is style has been widely influenced by the teachings of Benjamin Graham and Warren Buffett. Investing Strategy: Value Investor, Long term, Small Cap, Large Cap, Quantitative Investor

How did Joel Greenblatt Make his Money?

Joel Greenblatt is a hedge Fund manager and thus made his money from the fee’s charged to clients, in addition to his own investing gains. Greenblatt started his first hedge fund Gotham Capital with $7 million provided by the “Junk Bond King” Michael Milken.

Gotham Capital had some incredible investment returns of 50% compounded annually (after most expenses) and 30% (Minus all fee’s) between 1985 and 1994.

Greenblatt’s Hedge Fund specialized in “special situations” such as spinoffs and other corporate restructurings. A “Spinoff” is where a large company will create an independent business from a smaller part of the firm. For example, Ebay spun off Paypal in 2015.

Gotham Asset Management:

- In 1995 Gotham returned all capital of outside partners (approximately $500 million).

- In 2008 Gotham Asset Management was created as “the successor to Gotham Capital”.

- In 2010, Gotham started four mutual funds and raised $360 million. By 2014, the mutual funds managed over $1 billion.

- By 2014, this had increased to $4.8 billion thanks to new money inflows before peaking at around $13.1 billion in March 2015.

- In 2021 portfolio value stands at $2.36 Billion.

As value investing has underperformed over the past few years, the fund has gradually seen outflows and now the portfolio value stands at $2.36 Billion as of 2021.

What is Joel Greenblatt’s Magic Formula?

Joel Greenblatt’s Magic Formula is a quantitative method of investing into the stock market. The Magic Formula was popularised in his best selling investment book “The Little Book which beats the market”.

The formula works by screening for stocks with a low Price to earnings ratio (P/E) but also high returns on capital. Generally these two metrics offer a simplified method of buying “cheap stocks of good companies”.

Here is how the Magic Formula works:

1. Screen Stocks for Low P/E Ratio and High Returns on Capital (For example P/E Ratio less than 10, and Return on capital above 15%.)

2. Buy the top 20 of these stocks for diversification

3. Hold for one year (no matter what)

4. Then sell and repeat back to step 1.

The idea behind the Magic Formula is it removes the psychological biases (Greed, Fear, Fomo) etc which often causes investors to buy and sell stocks at the wrong time, for example during a stock market crash.

Multiple studies have shown simply buying cheap stocks with low price to earnings ratio’s & high returns on capital can outperform the market index.

Joel Greenblatt Magic Formula for Investing. Credit: www.Motivation2invest.com/Joel-Greenblatt-Quotes

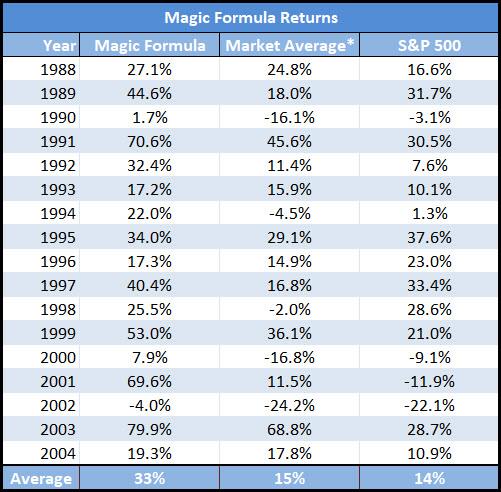

Does Magic Formula Investing work?

Greenblatt created the world famous “Magic formula” which is a systematic method of buying stocks with a low price to earnings ratio, high returns on capital and a few more metrics. A back-test of the Magic formula showed it returned an average of 33% compounded over the past 16 years, beating the market!

Magic_formula_book_Joel Greenblatt. Credit: The Little Book which beats the market.

However, it is clear to see the Magic formula does not beat the market every year and in recent years Momentum investing strategies have outperformed traditional quantitative value approaches.

Joel Greenblatt Quotes Magic Formula for Investing. Credit: www.Motivation2invest.com/Joel-Greenblatt-Quotes

Why be a Value Investor?

When asked, why he is a value investor? Greenblatt replied it seems the only logical way to invest. He gave the following example:

“If you were going to invest into a house what would your process look like? Would you buy the most expensive house…where the price had gone up recently? (that is Momentum trading) Or Would you look for a house which is trading for less than others in the area? (Relative valuation) Or Which had rental cash flows could calculate a payback period? That is Value investing. (Intrinsic Valuation)

Greenblatt & Michael Burry (Big Short):

Gotham Capital helped “Big short’s” Michael Burry create his Legendary hedge fund Scion Capital in the year 2000. Greenblatt purchased 25% of its capital for one million dollars after all taxes.

By October 2006, Gotham’s investment in Scion Capital amounted to $100 million! Now this is where things get interesting…Burry was controversially betting against the US Housing Market (Big Short). However, Greenblatt didn’t like this strategy (even though it did ultimately pay off!).

Thus Greenblatt and other investors wanted their money back. Now in the “Big Short” Movie “Lawrence Fields” (played by Tracy Letts) is meant to represent the investors who were invested with Burry such as Greenblatt.

Although the physical resemblance is not similar to Joel Greenblatt. This character is a fictional version meant to represent him and other disgruntled investors. I suppose Michael Burry doesn’t look like Christian Bale either.

Lawrence Fields (played by Tracy Letts) Big short. Although the physical resemblance is not similar to Joel Greenblatt. This character is a fictional version meant to represent him and other disgruntled investors. Source: www.motivation2invest.com/Joel-Greenblatt-Trades

After the dispute with Gotham Capital & Greenblatt, Burry used a special provision in his prospectus to “side pocket” or block withdrawals which amounted to approximately 55% of Greenblatt’s investment!

Not surprisingly this amount corresponded to his “Big short bet” (Credit default swaps) which were then losing money. Gotham Capital even threatened to sue Burry for blocking the withdrawals. Despite the pressure Burry held on until he was in profit on August 31, 2007 as the housing market crashed.

Scion Capital fund was then up by over 100%. Gotham Capital exited its investments. Joel Greenblatt must be kicking himself at the missed opportunity.

Top 10 Quotes by Joel Greenblatt

10. The Magic Formula

Joel Greenblatt Quotes Magic Formula for Investing. Credit: www.Motivation2invest.com/Joel-Greenblatt-Quotes

A back-test of the Magic formula showed it returned an average of 33% compounded over the past 16 years, beating the market!

9. Understand Mr Market

Joel Greenblatt Quotes Magic Formula for Investing. Credit: www.Motivation2invest.com/Joel-Greenblatt-Quotes

“In the short term Mr Market sets prices with emotion, in the long term prices revert to value” – Joel Greenblatt (Value Investor) Benjamin Graham the father of value investing uses the analogy of Mr Market to explain the stock market. Mr Market is like a bipolar person who wakes up every day, either very optimistic or pessimistic.

Each day he knocks onto your house door and gives you a quote to buy your house. When Mr Market is feeling optimistic he will offer alot and when pessimistic he will offer a little. The trick for investing success is to only do business with Mr Market when it benefits you. As Sir John Templeton said “Be a realist, Buy from the pessimists and sell to the optimists”.

8. Stock Prices move faster than business value

Joel Greenblatt Quotes Magic Formula for Investing. Credit: www.Motivation2invest.com/Joel-Greenblatt-Quotes

“Stock Prices move wildly in short periods, this doesn’t mean the value of the business had changed much” – Joel Greenblatt.

7. High Returns on Capital

Joel Greenblatt Quotes Magic Formula for Investing. Credit: www.Motivation2invest.com/Joel-Greenblatt-Quotes

“Companies that achieve a high return on capital have a special advantage of some kind” – Joel Greenblatt (Value Investor) . Return on capital is a metric which measures how well a company reinvests and the return they achieve. For example, for every $1 invested how many dollars does the company get back, $2, $3 etc.

Generally a companies “competitive advantage, moat” or pricing power can show up in the metrics such as Return on Capital.

For example, Amazon has consistently invested well and achieved a return on capital of 20% historically and 10% now. This is good but a company like Apple has done even better with a Return on Capital of 48.3%! This reflects Apples strong pricing power and efficiency improvements.

Formula for Return on Capital

Return on Capital (ROC) = (Net Income-Dividends)/(Debt+Equity)

For Example: A small public company has $100,000 in net income with $600,000 in total debt and $100,000 in shareholder equity. Plugging into the Return on capital formula, ($100,000 Net Income- zero Dividends) divided by ($600,000 + $100,000) = ROC. Thus the Return on Capital is 14.3%.

What is a Good Return on Capital?

Generally a return on capital over 10% consistently is good, 15% to 20%+ is great. Apple has historically had a return on capital of over 39% which is incredible!

6. Be a Value Investor

Joel Greenblatt Quotes Magic Formula for Investing. Credit: www.Motivation2invest.com/Joel-Greenblatt-Quotes

“The secret to investing is to figure out the value of something then pay alot less” – Joel Greenblatt (Value Investor).

This is obvious secret of value investing. As the father of Value Investing Benjamin Graham once said, a stock is a portion of a company. Thus the strategy with value investing is to value a company then buy below that fair value with a margin of safety.

Want to learn how to Value Stocks?

If you want to learn how to value stocks like Buffett, but with a growth twist check out our: Investing Strategy Course

5. Assess Risk First

Joel Greenblatt Quotes Magic Formula for Investing. Credit: www.Motivation2invest.com/Joel-Greenblatt-Quotes

“Look down not up when making your initial investment decision, focus on not losing money then let the upside take care of itself” – Joel Greenblatt (Value Investor) It is very easy to focus on the upside when making an investment decision, thinking about all the money you could make.

However, that is usually the most dangerous way to invest. Great Value Investors assess the risk first and aim to mitigate that. If the worst case is you lose 1x and the best case is a 4x then that is usually a great bet to take. This is an asymmetric risk/reward ratio, as Billionaire Hedge Fund manager Ray Dalio would call it.

4. Value always prevails

Joel Greenblatt Quotes Magic Formula for Investing. Credit: www.Motivation2invest.com/Joel-Greenblatt-Quotes

When speaking to his MBA students during an investment class, Greenblatt stated: “I Guarantee a stock will revert to it’s value at some point…but I can’t guarantee when” .

This is one of the most difficult parts of value investing, even if you know a stock is undervalued or overvalued, there is no way of knowing when the stock market fundamentals will correct.

Thus it’s generally best to look for some kind of “catalyst” which could cause the stock to correct to fundamentals this could be a news update, financial update or business update.

3. Know what you own

Joel Greenblatt Quotes Magic Formula for Investing. Credit: www.Motivation2invest.com/Joel-Greenblatt-Quotes

“Putting all your eggs in one basket and watching that basket closely is less risky than you may think” – Joel Greenblatt (Value Investor) . Many business schools teach “Diversification” as a key fundamental investing strategy.

However, Many Legendary investors including, Warren Buffett, Charlie Munger, Mohnish Pabrai, Seth Klarman and of course Joel Greenblatt believe the opposite. It’s not that diversification doesn’t work, it’s just difficult to diversify and also know everything about each investment.

A focused portfolio allows you to gain deep insight into one area and make decisions to “load up the truck” when the odd’s are in your favour. (This is not financial advice)

2. Invest Long Term

Joel Greenblatt Quotes Magic Formula for Investing. Credit: www.Motivation2invest.com/Joel-Greenblatt-Quotes

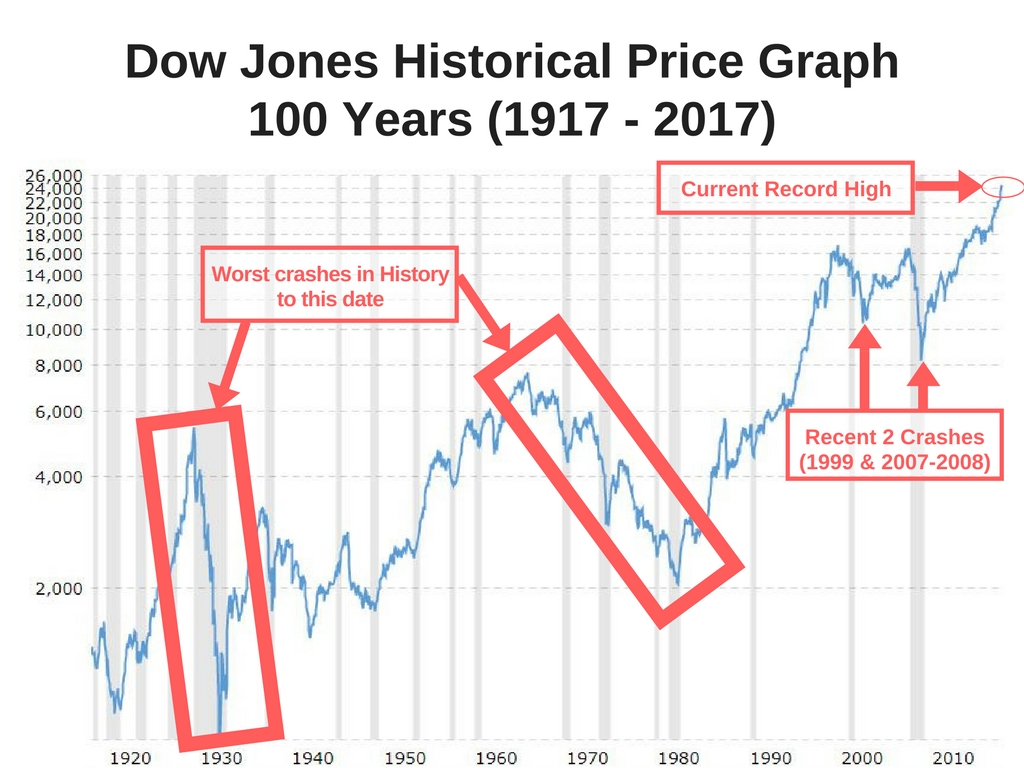

“Having a 3 to 5 year horizon for your stock investments should give you an advantage over most others” – Joel Greenblatt (Value Investor). Most people are too short term focused especially when stocks crash.

Despite many stock market crashes from the great depression in the 1930’s, to Black Monday in 1987, Dot Com Bubble (2000), Financial Crisis (2008), Pandemic Crash (2020). The stock market has crashed and risen once again.

History of Stock Market Crashes

1. Learn to Invest, don’t gamble

Joel Greenblatt Quotes Magic Formula for Investing. Credit: www.Motivation2invest.com/Joel-Greenblatt-Quotes

“Picking stocks randomly is like running through a dynamite factory with burning match…you may live, but your still an idiot!” – Joel Greenblatt (Value Investor). This is a classic case of “Survivorship bias” lets say somebody invests randomly into a crazy crypto token because they heard someone talking about it on mainstream news and it 10X’s in price and makes them a Millionaire.

Does that mean it was a good strategy? Not so as if they continued their strategy of investing blindly then in the end it would fail. Luck plays a role in every investment outcome so it’s best to focus on having a solid process.

Want to learn how to Value Stocks?

If you want to learn how to value stocks like Buffett, but with a growth twist check out our: Stock Research Platform