He is famous for investing during stock market crashes & when there is fear in the market.

Investment Strategy: Contrarian, Value Investor

15. “The Time of Maximum pessimism is the BEST time to Buy…”

John Templeton MOTIVATION 2 INVEST Quotes (1) Credit: www.Motivation2invest.com/John-Templeton-Quotes

The Time of Maximum PESSIMISM is the Best time to BUY, the time of maximum OPTIMISM is the best time to SELL. When stocks crash and fear grips the stock market, people perceive a greater risk. However, stocks are actually LESS RISKY as they are cheaper to buy…effectively stocks are on sale.

The same is true when stocks go up and euphoria is prominent, the perception from the media is now you should buy, when actually that is the most dangerous time to buy and the best time to sell.

This is very similar to Legendary Investor Warren Buffett’s quote: “Be fearful when others are greedy and greedy when others are fearful”.

This sounds easy on paper but during the heat of a stock market crash it requires immense courage and independent thinking to buy when others are selling in fear.

14. “Invest when there is blood on the streets”

John Templeton MOTIVATION 2 INVEST Quotes (1)Credit: www.Motivation2invest.com/John-Templeton-Quotes

The Ultimate Contrarian (World War 2) Investment:

An extreme example of this includes a bold investment during World War 2!

In 1939, WW2 was just beginning and the stock market crashed as most people were in fear (understandably).

However, Templeton saw this volatility as an opportunity.

He even borrowed thousands to buy 100 shares of EVERY STOCK selling for less than one dollar.

At that point one third of the companies faced bankruptcy, but he held his shares firm. After which all but four stocks rebounded, which made him an incredible 400% return in just 4 years!

13. “Bull Marks are born on Pessimism…die on Euphoria”

John Templeton MOTIVATION 2 INVEST Quotes (1 (3). www.Motivation2invest.com/John-Templeton-Quotes

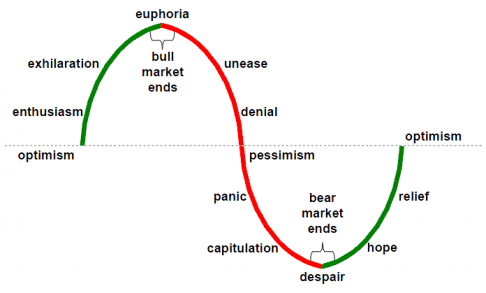

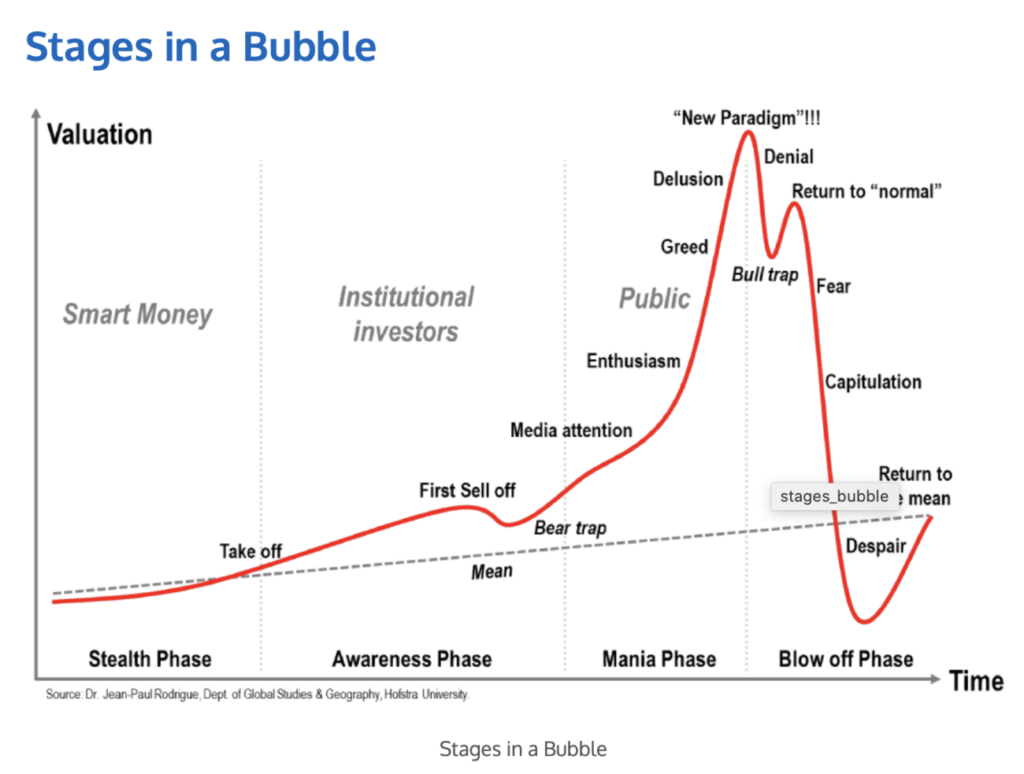

“Bull Marks are born on Pessimism, Mature on Optimism and die on Euphoria”. The stock market moves in cycles, from pessimism to optimism and back again.

This is fundamental movement is governed by the psychology of human beings which are driven by fear and greed. This is one of the main reasons we see multiple asset prices bubbles then stock market crashes. From the Tulip Bubble in Holland, to the Dot Com bubble (late 90’s), the financial crisis etc.

Stock Market Moves in Cycles from fear to greed

12. “This Time it’s different”

John Templeton MOTIVATION 2 INVEST Quotes (1 (4)

When the phrase “This time it’s different” get’s thrown around by the general consensus of investors and the media, then is usually a time to worry. From the dot com bubble in the late 90’s when investors said “this time it’s different”, “the internet will change the world”.

Stock Market Bubble

They were correct, but EVERY BUBBLE STARTS WITH A NUGGET OF TRUTH. The internet did change the world and is a great technology but that doesn’t mean any price could be paid for internet stocks.

This may be happening again today with the euphoria around cryptocurrency, blockchain is a fantastic technology (as was the internet) , but what is the true value of the many tokens?

11. “Focus on Value, most investors just focus on outlook & trends”

John Templeton MOTIVATION 2 INVEST Quotes (1 (10). Credit: www.Motivation2invest.com/John-Templeton-Quotes

Very few investors actually understand how to value a companies stock. Many just focus on trends and hype such as “the electric vehicle market, crypto mining stocks etc”.

How to Value a Stock?

We live in a society where everybody knows the price of anything but the value of nothing! To invest well, valuation is the key.

Relative Valuation involves comparing simple metrics like PE Ratio (Price to earnings ratio), PS Ratio (Price to Sales Ratio) , EV/EBITDA (Enterprise value/Earnings before interest, taxes, depreciation, amortization)

Intrinsic Value is the value of the companies future cash flows. To calculate this we use a DCF Model (Discounted Cash flow). We forecast the companies future cash flows then discount back to today. As a dollar in our hand today is worth more than a dollar in the future, as there is less risk, uncertainty and the opportunity cost.

Want to learn how to invest?

To learn how to value stocks (step by step) and get access to our advanced valuation model (with 55 stocks+ valued) check out our investing strategy course & VIP community to find out more. Stock Research Platform

10. “Don’t Panic….Sell BEFORE the market crash”

John Templeton MOTIVATION 2 INVEST Quotes (1 (6)Credit: www.Motivation2invest.com/John-Templeton-Quotes

Panic doesn’t help anybody and when stocks turn red as the market crashes, fear can grip us. The important factor to remember is not to panic as “the time to sell is before the market crash”. Thus when excitement and euphoria reign supreme, “Sell to the optimists” in the words of Benjamin Graham.

9. Be a Contrarian to win

John Templeton MOTIVATION 2 INVEST Quotes (1 (7). Credit: www.Motivation2invest.com/John-Templeton-Quotes

“If you want performance better than the crowd, you must do things differently” . To be a successful contrarian you must bet against the consensus and be right. John Templeton has always been an independent thinker who does thinks differently than the crowd.

Even if you look at his daily habits, he wakes up every morning and goes walking in the sea, yes “walking”. He doesn’t care if this is not “normal” and looks different to others as he says it’s great exercise for him. He literally does walk against the tide!

John Templeton. Credit: templetonprize.com

8. To be Wealthy, Create Riches for others

John Templeton MOTIVATION 2 INVEST Quotes (1 (11)Credit: www.Motivation2invest.com/John-Templeton-Quotes

“The Secret to getting Wealthy is to create riches for others”. If you want to become a Millionaire ask how can I help 1 million people, or how can i help 10 people with enough value that they would consider paying $100k each.

You can also invest into companies which are truly providing a valuable product to their users. This could be a unique product, a service, an experience etc. Warren Buffett often talks about the difference between “Wealth Creation & Wealth Transfer”

7. Find a way…not an excuse

John Templeton MOTIVATION 2 INVEST Quotes (1 (5) Credit: www.Motivation2invest.com/John-Templeton-Quotes

Sir John Templeton doesn’t just give great investing advice but also great life advice. If your really want something in life you will find a way to achieve it, whereas most people will find an excuse.

A great characteristic to look for in successful founders and CEO’s is those who “find a way”, think Jeff Bezos, Elon Musk, Bill Gates and more. Investing with great founders is a great success strategy used by Legendary investors such as Nick Sleep.

Nick Sleep Nomad Investment Partners Letters Quotes. Returns if invested into Tesla Stock or Amazon. Source: Motivation2invest.com

6. Ask the right questions…

John Templeton MOTIVATION 2 INVEST Quotes (1 (8)Credit: www.Motivation2invest.com/John-Templeton-Quotes

Success is about continually seeking answers to new questions. Legendary Investor Charlie Munger likes to “Invert problems” in order to ask even better questions.

5. Be Humble…

John Templeton MOTIVATION 2 INVEST Quotes (1 (9) Credit: www.Motivation2invest.com/John-Templeton-Quotes

Investing success requires you to be humble, it is impossible to know everything about everything. Thus, it’s ideal to be self aware and understand what you know and don’t know. Warren Buffett call’s this his “Circle of competence”, Buffett often states he doesn’t invest into technology for this reason.

Peter Lynch says “Know what you own” and loves “simple businesses”. Even Billionaire hedge fund manager Ray Dalio seeks out credible people who disagree with him to understand if he’s covered all angles.

4. Rejoice because thorns have roses…

John Templeton MOTIVATION 2 INVEST Quotes (1 (13)Credit: www.Motivation2invest.com/John-Templeton-Quotes

“You can complain because roses have thorns or rejoice because thorns have roses” This is a great quote on looking at the positive side of a situation and living a fulfilled and happy life.

3. Be Grateful…

John Templeton MOTIVATION 2 INVEST Quotes (1 (14)Credit: www.Motivation2invest.com/John-Templeton-Quotes

“If your not grateful, your not rich, no matter how much you have”. Gratitude is the key to happiness in life. Charlie Munger talks about “lowering your expectations” and being grateful for the moment.

I personally believe “low expectations and high goals” are a great way to fulfilment, thus you are enjoying the journey but still moving towards great things.

2. Happiness comes from Spiritual Wealth…

John Templeton MOTIVATION 2 INVEST Quotes (1 (12)Credit: www.Motivation2invest.com/John-Templeton-Quotes

Jim Carrey once stated “‘I think everybody should get rich and famous and do everything they ever dreamed of so they can see that it’s not the answer.'” True happiness comes from spiritual wealth. There was also a long term happiness study done by Harvard over a 75 year period following the life’s of men. Those who were happiness tended to have “strong relationships” from family, friends, partners. These people actually lived longer and were healthier also. Various Studies from places such as Princeton University, show that money only buys happiness up to approximately $75,000 per year depending upon country.

1. Don’t surrender freedom for security

John Templeton MOTIVATION 2 INVEST Quotes (1 (15)Credit: www.Motivation2invest.com/John-Templeton-Quotes

“Those who surrender freedom for security, will not have either” . In life it can sometimes feel safer to take that “secure job” or not invest as it’s “too risky”, but usually this ends up being more dangerous in the long term, when that “safe job” disappears and your “safe money” in the bank gets devalued by inflation.

Want to learn how to invest?

If you want to learn how to invest like the greatest investors of all time such as Warren Buffett, then check out our ultimate Investing strategy course.

You also get access to our entire Stock research platform and our thriving VIP Membership group. Where you will be supported by like minded investors at all levels from complete beginner to advanced.

Membership is only open for a limited time only every month as we try to keep the quality high. As a special treat if you use the promo code “m2iinstagram10” you get $10 discount!