Metaverse Image Gallery |Meta & Microsoft

The Metaverse is set to be the next major technology platform. This would basically be an immersive virtual world where people can live, work and play…basically a real life version of the Matrix, but hopefully without Agents trying to take you out!

The Metaverse is not necessarily a new technology in itself but it will be a combination of many cutting technologies which will intercept in the Metaverse.

These technologies include:

- Virtual Reality (VR)

- Augmented Reality (AR)

- Artificial Intelligence (AR)

- Big Data

- 5G technology

- High performance computing (HPC)

- Visualisation

- Blockchain technology.

- and many more!

Inside the Metaverse you will be able to meet friends, visit an NFT (Non Fungible Token) Art Museum, Buy a virtual coffee using cryptocurrency and socialise or even have a business meeting. Thus in this post i’m going to reveal the top 5 stocks to play the Metaverse future.

Personal Background: I completed my University thesis on Augmented Reality and the Metaverse way back in 2014!

FACEBOOK METAVERSE STOCKS FACEBOOK CONNECT CONFERENCE. Work Reimagined. Screenshot of Facebook connect by. https://www.motivation2invest.com/metaverse-stocks/

1. META (Facebook) (MVRS)

Facebook made global headlines when they announced in October to be changing their name to “Meta” which is short for the “Metaverse”. CEO Zuckerberg stated:

“Today we are seen as a social media company, but in our DNA we are a company that builds technology to connect people and the metaverse is the next frontier just like social networking was when we go started”

Zuckerberg then proceeded to show a video clip which showed him convert to an avatar and interact with friends inside what would be the “metaverse” of the future.

Meta owns Oculus the leader in Virtual Reality Goggles which they acquired in 2014, devices such as these can also be used today with platforms such as Facebook Horizons a Virtual world where you can walk around as an Avatar, this is really the seed of what would be a full blown metaverse.

The challenge for Meta now will be to gradually reduce the size and cost of the Oculus VR Headsets in order to reach more people. Zuckerberg stated:

We continually lower the cost of our Oculus Headsets & sell below cost, bringing the price down from $399 to $299 was a strategic move to encourage people to embrace VR

FACEBOOK METAVERSE MARK ZUCKERBERG CHANGING INTO HIS AVATAR. Screenshot of Facebook connect by. https://www.motivation2invest.com/metaverse-stocks/

In an Interview with CNET Zuckerberg stated the Oculus Quest’s greatest strength against competition was it’s convenient wire-free design and lower cost.

However, Zuckerberg also plans to upgrade the Virtual reality with the Quest Pro. This will include face & eye tracking and will be sensitive enough to make allowances for those with beards etc.

The idea of Quest Pro is to create the ultimate sense of “presence”. This will be at the top end price point as Zuckerberg stated “there’s some ability for it to be a little more expensive.” Meta’s overall goal is to leverage the reach of their social media platforms to increase engagement in Virtual Reality and ultimately the “Metaverse”.

Virtual Reality Headsets still make up a small niche market with just 5.5 million headsets sold last year.

FACEBOOK METAVERSE STOCK FACEBOOK CONNECT CONFERENCE, . Screenshot of Microsoft Mesh (Ignite conference) by. https://www.motivation2invest.com/metaverse-stocks/

What about Facebook??

Changing Facebook’s company name to Metaverse was a very bold move by Zuckerberg, as “Meta” still makes over 97% of their revenue from advertising on the social media apps (Facebook & Instagram).

Many critics also believed Zuckerberg was distancing the company from the Whistle-blower report, where an insider released internal studies by Facebook showing

Instagram, negatively affects young users’ mental health. According to one Facebook study leaked by Haugen:

- 13.5% of U.K. teen girls said Instagram worsens suicidal thoughts.

- 17% of teen girls say their eating disorders got worse after Instagram use.

This is no surprise to many experts in the space which have highlighted similar issues in past studies.

Thus Facebooks new name change has been likened to an Indian restaurant which gave someone food poisoning and has now reopened as a Greek Restaurant with a new name. Various Memes became abundant after the name change. My Favourite was “FETA”. Credit to the unknown creator.

View this post on Instagram

On a more serious note, the platform social media platforms are designed to be addictive. According to Business insider:

“Americans check their phones 262 times a day on average.”

App developer Peter Mezyk says Facebook and Instagram users can become dependent on apps as one would painkillers.”

and According to the Guardian.

“Social Media Copies Gambling methods to create psychological cravings”

App Blockers and screen time apps are becoming increasingly popular, a quick review of the google play store (yes I have an android) showed App blocks with over 5 million downloads.

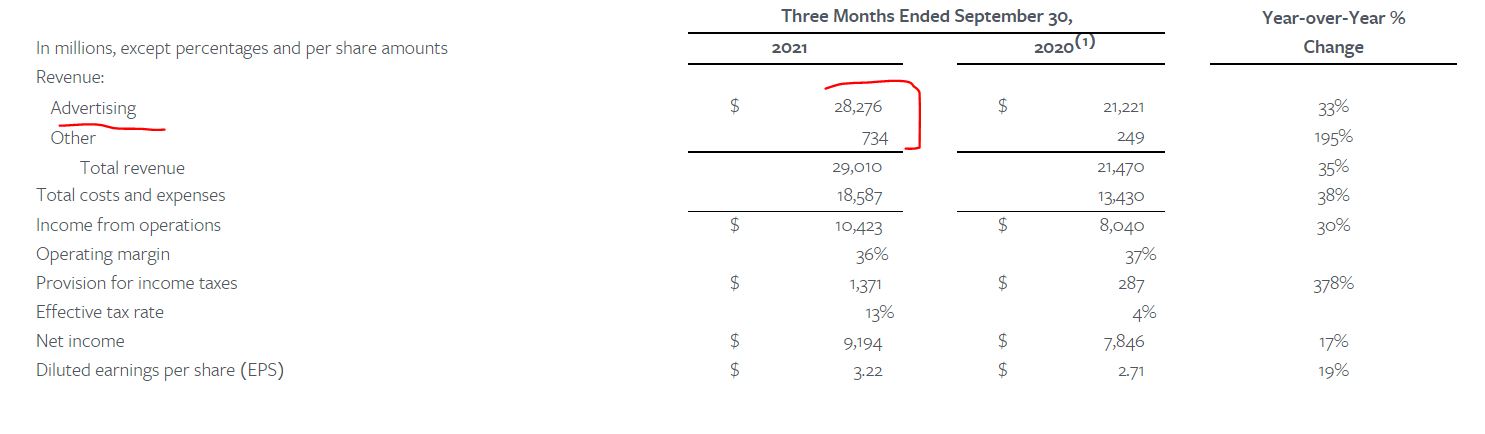

Metrics & Financials

Meta has now split into two reporting segments:

- Family of Apps (FoA), ( Facebook, Instagram, Messenger, WhatsApp)

- Facebook Reality Labs (FRL), ( augmented and virtual reality, Oculus etc)

As mentioned prior “Meta” still makes over 97% of their revenue from advertising on the social media apps (Facebook & Instagram).

FACEBOOK ADVERTISING REVENUES. Source: Facebook Investor relations

Sales Growth is up 35% year over year and earnings per share is up 19%.

Meta’s revenue from “other” which i’m assuming includes sales of Oculus headsets is there fastest growing segment up 195% on a percentage basis.

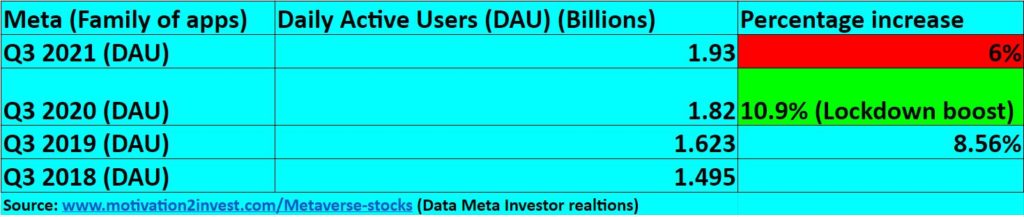

User growth rate is slowing

Active User growth is still growing at 6% year over year…but the growth rate is started to slow down. From a massive 10.9% (Q3 2020) which was boosted by lockdown and even prior to that 8.56% user growth was still higher. I believe this trend will continue and is also another reason for Facebooks pivot to Meta.

- Facebook daily active users (DAUs) – DAUs were 1.93 billion on average for September 2021, an increase of 6% year-over-year.

- Facebook monthly active users (MAUs) – MAUs were 2.91 billion as of September 30, 2021, an increase of 6% year-over-year.

META FACEBOOK USER GROWTH SLOWING. Source: www.motivation2invest.com/Metaverse-stocks

Facebook Daily Active users. Source: Statista

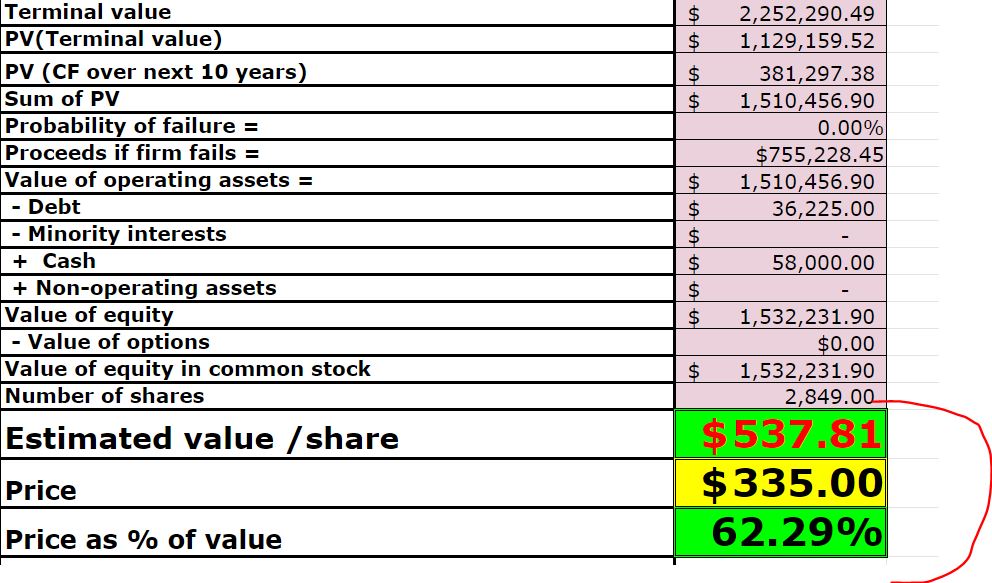

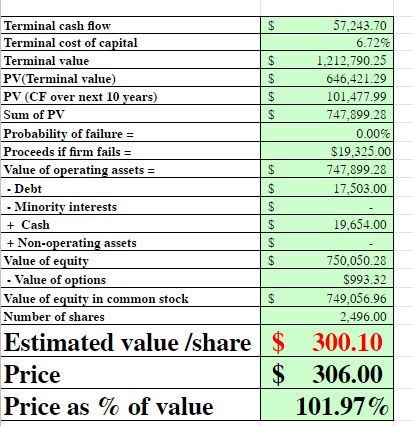

Advanced Valuation Model

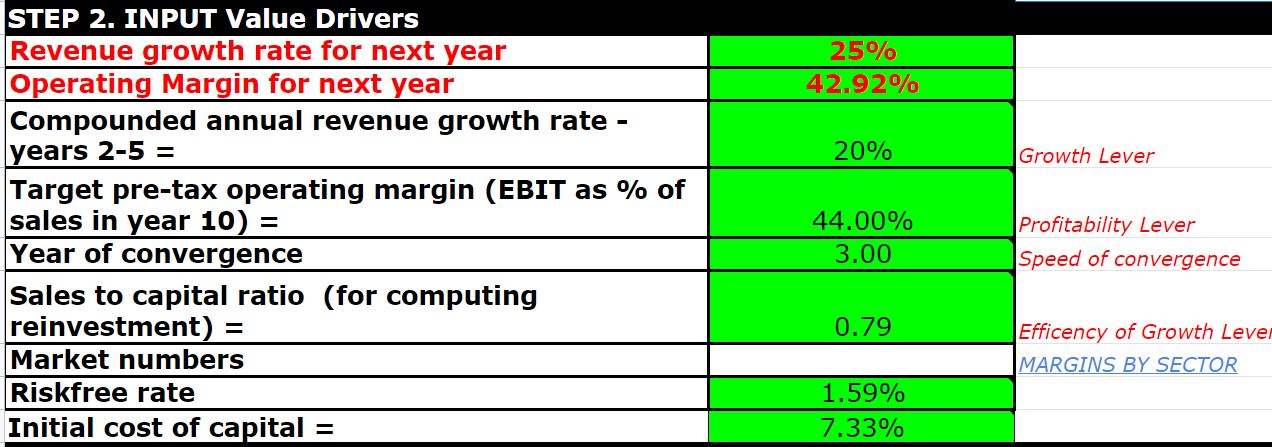

Diving into my advanced valuation, I completed a conservative valuation of Meta assuming the follow:

- Revenue Growth Rate decrease from 35% to 25% (2022)

- Compounded Growth rate (next 2 to 5 years) 20%

- Pretax operating margin increase to 44% up from 42.36%

The company also has $58 Billion in cash so plenty of dry powder read to invest into the metaverse.

VALUATION MODEL FACEBOOK META STOCK ASSUMPTIONS. Download all valuation models for over 65+ stocks on our stock research platform.

META STOCK VALUATION ANALYSIS UNDERVALUED. Download all valuation models for over 65+ stocks on our stock research platform.

According my advanced valuation model, I get a fair value for Meta stock (Formerly Facebook stock) of $537 per share, the price is currently just $335 thus the stock is undervalued.

Great Founder & Fast Follow Strategy

GREAT FOUNDER MARK ZUCKERBERG (12% stake) and MANAGEMENT (Sheryl Sandberg) .

Zuckerberg is the founder of Meta, he is a humble visionary and a strategic genius. Zuck follows a very similar strategy to Microsoft in the late 90’s, “Fast Follow”. When a new competitor product starts to gain traction, Meta (formerly Facebook) try’s to acquire or just copies fast. Examples

- INSTAGRAM (ACQUISITION)

- Oculus (Acquisition)

- Whatsapp (Acquisition)

- SNAPCHAT (Copy with Instagram stories) ,

- TIK TOK (Copy with Instagram REELS),

- YOUTUBE (IGTV).

- Clubhouse (Facebook Rooms)

For me the future of Facebook is a bet on the execution skills of Mark Zuckerberg and his ability to continually pivot the company, as he has done previously. If Zuckerberg left (which i don’t think he will) , I would seriously consider selling the stock.

This is not financial advice and there is still the risk of Meta core social media platforms, starting to decline and the chance that the “metaverse” is not widely adopted. In my eyes, a bet on Meta is a bet on the skills of Zuckerberg to pivot once again.

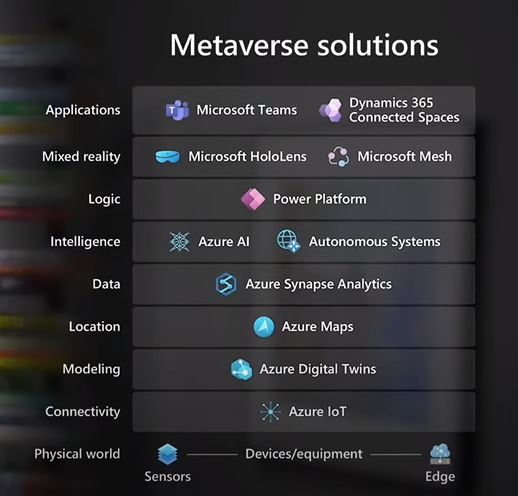

Stock 2. Microsoft (MSFT)

Microsoft also will be a major player in the creation of the Metaverse.

MICROSOFT MESH METAVERSE VIRTUAL REALITY. Screenshot of Microsoft Mesh (Ignite conference) by. https://www.motivation2invest.com/metaverse-stocks/

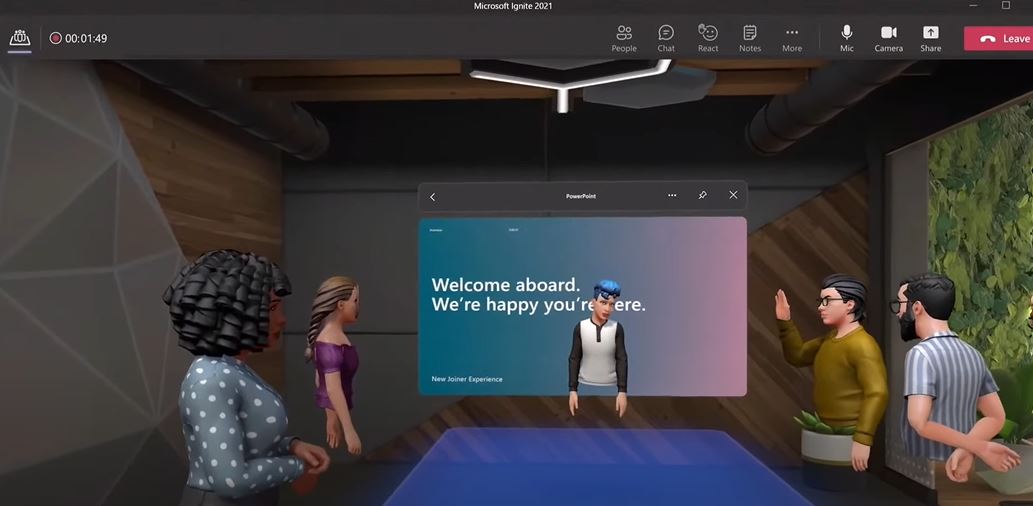

CEO Satya Nadella stated at Microsoft Ignite (Nov 2021):

As the Digital and Physical Worlds come together we are creating an entirely new platform called the Metaverse

The Metaverse enables us to embed computing in the real world and to embed the real world into computing, brining real presence to any digital space.

No Longer just video conferencing with colleagues you can be with them in the same room

The metaverse is here, and it’s not only transforming how we see the world but how we participate in it – from the factory floor to the meeting room. Take a look. pic.twitter.com/h5tsdYMXRD

— Satya Nadella (@satyanadella) November 2, 2021

Microsoft owns Virtual Reality platform (HoloLens), Gaming Platform Xbox and Microsoft Teams.

Microsoft Teams saw a huge increase in users during lockdown:

- From 20 million users in November 2019 to 44 million in March 2020, then 75 million by April.

- June 2021, Microsoft teams has 145 million daily active users.

- According to data from digital experience company Aternity, Microsoft Teams growth surpassed Zoom from February to June.

- Microsoft Teams generated an estimated $6.8 billion in revenue in 2020, a 700 percent increase year-on-year

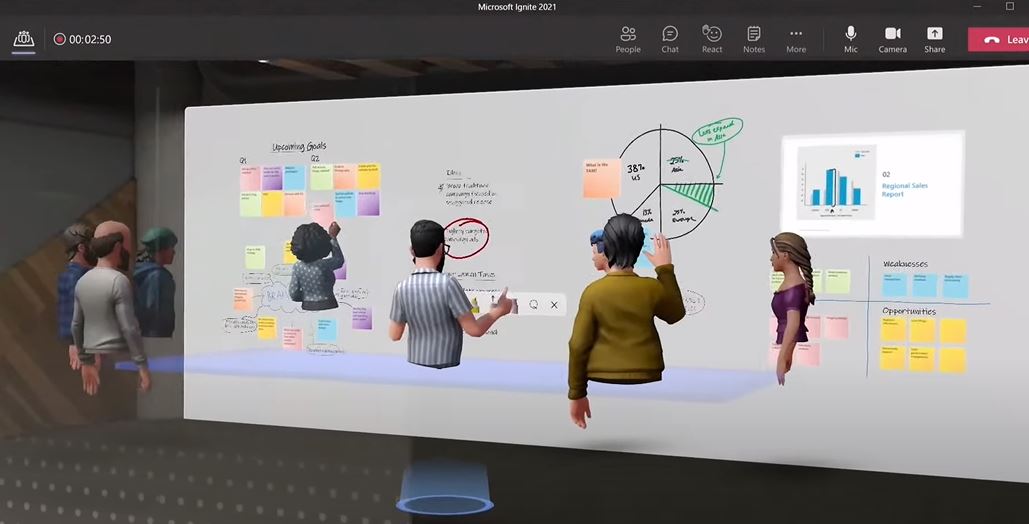

MICROSOFT MESH METAVERSE VIRTUAL REALITY. Team meetings of the future Screenshot of Microsoft Mesh (Ignite conference) by. https://www.motivation2invest.com/metaverse-stocks/

Microsoft announced, Mesh for Microsoft Teams which will allow a shared immersive experience directly in teams. The beautiful thing about Microsoft’s Metaverse environment is it is directly accessible seamlessly through teams, leveraging the huge (145 million) daily active users. This also removes the friction associated with the platforms.

Inside Mesh Users will be able to interact as a virtual avatar with others and the idea according to Satya Nadella is to replicate the “Water Cooler” style chat.

The Avatars also show real time facial expressions to create that sense of presence. The platform has lots of potential for “Virtual team” gatherings as many companies are going remote.

Microsoft is Number 2 player in Cloud Computing Microsoft Azure, thus has plenty of capacity to run platforms at scale.

MICROSOFT MESH METAVERSE VIRTUAL REALITY. Work place collaboration of the future, Team brainstorming ideas on a whiteboard similar to the real world. Screenshot of Microsoft Mesh (Ignite conference) by. https://www.motivation2invest.com/metaverse-stocks/

Microsoft Business Model

Microsoft’s revenues:

- Cloud services (No 2 Player Azure),

- Productivity software (Windows 365, Teams)

- More Personal Computing ( hardware, software, and gaming systems.) (Xbox, HoloLens etc) .

Microsoft’s cloud solution, brings in more revenues than its Windows operating system and witnessed exponential growth during lockdown! Sales Surged by over 50% year over year. Q3 2021, Cloud revenue up 33% year over year.

Microsoft 365 had 300 million paid seats in Q3 2021 and Microsoft Office, the company’s productivity suite, has over 50 million subscribers.

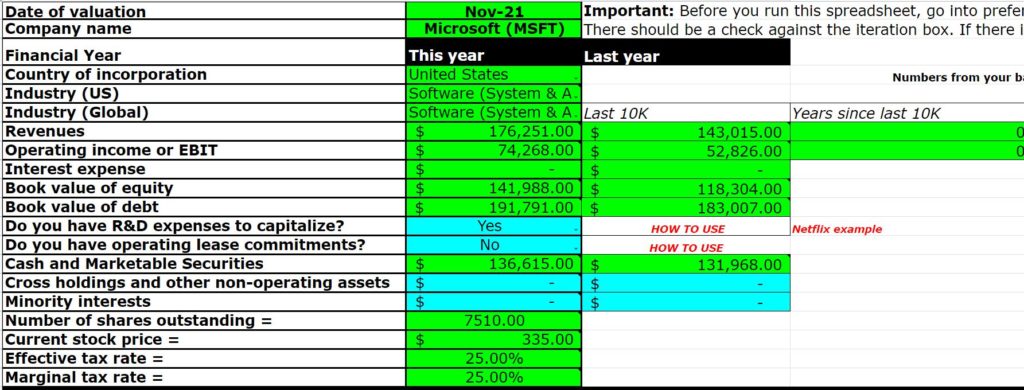

Microsoft Financials & Valuation

Earnings Release FY21 Q3

- Revenue was $41.7 billion and increased 19%

- Operating income was $17.0 billion and increased 31%

- $136 Billion in Cash!

MICROSOFT VALUATION MODEL PART 1. FINANCIALS. Download all valuation models for over 65+ stocks on our stock research platform.

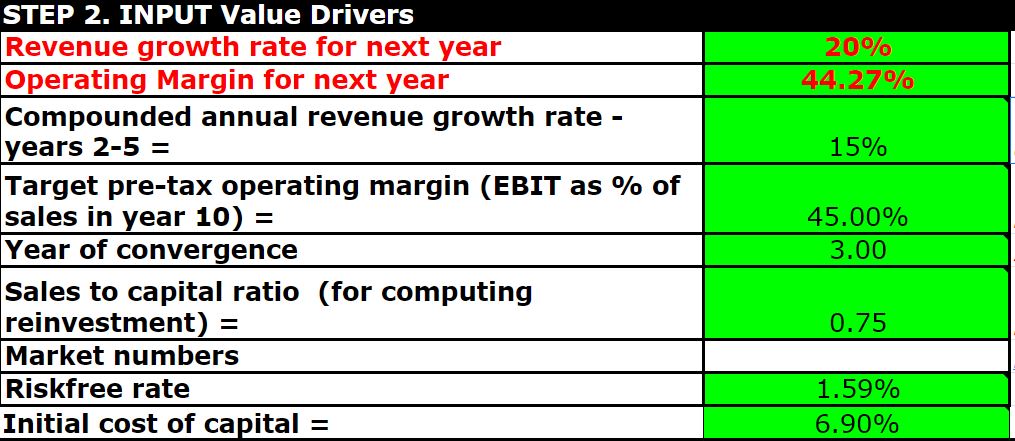

Below I have completed conservative estimates of future growth:

- 20% Revenue Growth for next year (Similar to prior 19%)

- Reduce to 15% thereafter

MICROSOFT VALUATION MODEL PART 2. GROWTH ESTIMATES. . Download all valuation models for over 65+ stocks on our stock research platform.

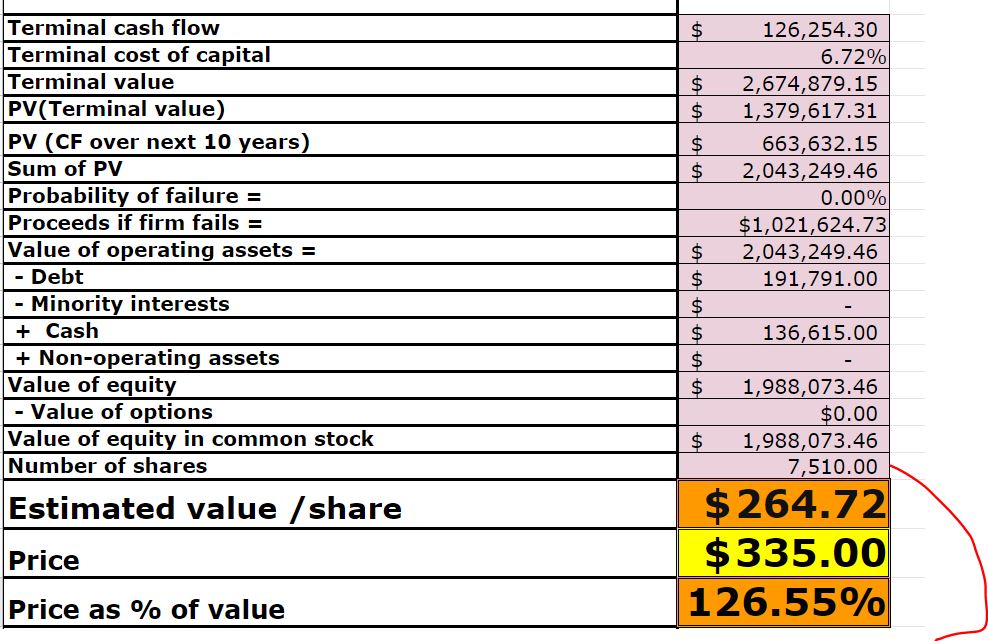

MICROSOFT STOCK VALUATION MODEL PART 3. Stock Overvalued/ . Download all valuation models for over 65+ stocks on our stock research platform.

From the above valuation Microsoft Stock looks to be 26% overvalued.

Stock 3. NVIDA (NVDA)

Nvidia (NVDA) is a market leader in Graphics cards (Gaming), Data centres, Visualisation & Artificial Intelligence. NVIDIA could be the technological backbone behind many future Metaverse platforms. In August 2021, NVIDIA Announced the Omniverse:

“We are thrilled to have launched NVIDIA Omniverse, a simulation platform nearly five years in the making that runs physically realistic virtual worlds and connects to other digital platforms.We imagine engineers, designers and even autonomous machines connecting to Omniverse to create digital twins and industrial metaverses,”

The company is growing rapid.

- Q2 revenue $6.51 billion, up 68% Year over year.

- Record Gaming revenue of $3.06 billion, up 85% Year over year.

- Record Data Center revenue of $2.37 billion, 35% Year over year.

NVIDIA STOCK FAIRLY VALUED. . Download all valuation models for over 65+ stocks on our stock research platform.

From my valuation Model using conservative growth estimates of 50% next year and 40% for the next 2 to 5 years NVidia Looks fairly valued.

Stock 4. ROBLOX (RBLX)

Roblox is the popular online gaming platform which saw growth accelerate during the lockdown! The platform has over 43.2 million daily active users and its own Virtual currency (Robux). Inside the game players can use their “Robux” to buy items for their Avatar and even purchase tickets to unique experiences.

For example in 2020, there was a live digital concert by Lil Nas X.

Roblox is also building a community of developers to build on top of the platform, many developers are making very good money building for the platform currently.

With 1.3 million developers on track to earn $500 million collectively from their developed apps in 2021.

Roblox stock analysis. Image credit: Appleinsider.com

The stock popped by 42% today after revenue doubled in Q3 2021.

Roblox stock up 42%.

I previously covered Roblox Just after their IPO. Video Below

Stock 5. UNITY (U)

Unity is a Leading game development engine which could be the backbone for the future Metaverse.

- Gaming: Pokemon Go, partnerships with UBISOFT (Assassins creed identity mobile game) , League of Legends (Mobile) escape plan, temple run.

- Partnerships: Facebook Integration for unity developers to create games. This could be a major catalyst for the stock now Facebook has gone all in on the “Metaverse”

Google partnership with android for Augmented Reality games.

2 Million Monthly users with 15,000 new projects started daily. SEQUOIA CAPITAL INVESTED (Although they would have gotten a much better deal)

Unity Stock. Image credit: Studica.com.

I completed my University thesis on Augmented Reality and the Metaverse way back in 2014, I used the Unity platform for my project.

Matterport Stock – Bonus: Speculative VR stock

Want to access our real time stock picks & research?

Check out our Stock Research Platform to find out more. To learn how to be a great fundamental investor join our: Investing Strategy Course.

We only keep our group membership open for a limited time each month so be sure to click the links above to find out more.