Berkshire Hathaway loaded up on shares in Q1.

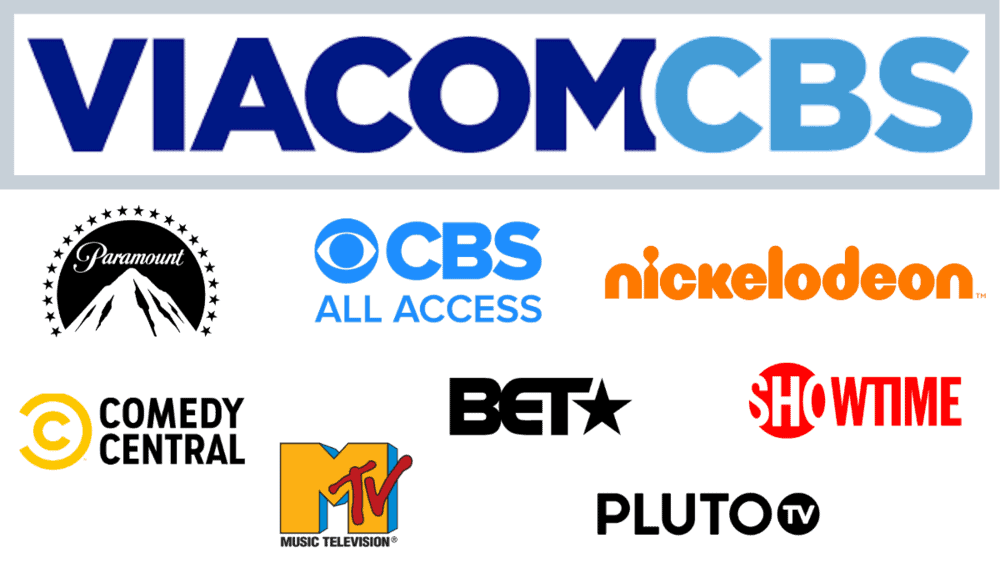

- Paramount Global (PARA) is a global media brand which owns CBS, Comedy Central, Channel 5, MTV, Showtime and much more.

- Paramount Pictures has the rights to iconic movies like The Godfather, Top Gun, Iron Man, the Titanic, Mission Impossible and more.

- Paramount+ streaming service has ~40 million paid subscribers and plans to reach 75 million by 2024.

- Berkshire Hathaway Bought shares in Q122, at an average price of $34/share.

Paramount Global (NASDAQ:PARA) is a global media brand which owns CBS, Comedy Central, Channel 5, MTV and much more. Berkshire Hathaway bought shares in Q122, at an average price of $34/share. Warren Buffett is now the largest shareholder in the company, as he now owns 10% of shares outstanding with an approximate value of $1.9 Billion at the time of writing, down from $2.6 Billion reported. Mario Gabelli of GAMCO investors was also buying shares in Q1, 2022. He increased his position by 152% and now owns 655,913 shares in Q1.

The stock price dropped to a low of $26/share on the 11th May and is up 8% in pre market trading. Let’s dive into the Business Model, Financials and Valuation to find out why Buffett has invested.

Leading Business with a Moat

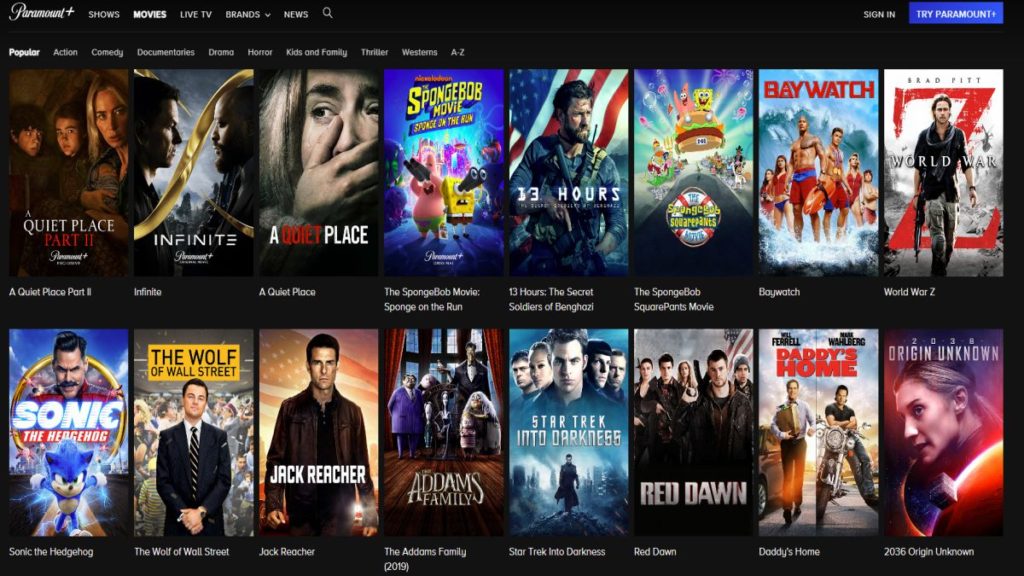

Paramount Global (PARA) is a global media brand which owns CBS, Comedy Central, Channel 5, MTV, Showtime and much more. Buffett likes to invest into companies with a “moat” or competitive advantage. In this case, Movie studios Paramount Pictures has the rights to leading Iconic movies which should act as a strong moat. These include; The Godfather, Top Gun, Forrest Gump, Iron Man, the Titanic, Star Trek, Mission Impossible, Transformers, and more.

The company even has partial ownership of the rights to the Indiana Jones Franchise along with Disney. These movie rights give the company the ability to do multiple future remakes and keep cashing in. For example, a new Top Gun movie has recently premiered in 2022. All four theatrical releases this year have reached #1 at the box office, which shows they have no sign of slowing down.

paramount-plus-movies-1

Brief History of Name Changes:

The company has been through various mergers and name changes over the years. In 2019 they were called ViacomCBS Inc. due the re-merger of the CBS Corporation and the “new” Viacom. In February 2022, they announced they would be changing their name to “Paramount Global” to represent all that they do, and being “Paramount” in the media landscape.

Paramount Media Studios

On the television side, Paramount Global is a market leader CBS is the #1 Broadcast network and has been for the past 14 years. While Comedy Central was rated the #1 cable entertainment network and includes iconic shows such as South Park. Nickelodeon produces nine of the top 10 kids shows which include “Paw Patrol.” Over the past few years the company has spent a fast amount of time acquiring an extensive library of Spanish speaking content, which is the 4th most popular language in the world.

paramount_global_by_ethanishere_df05goe-pre

Growth in Streaming:

Paramount+ was launched in 2014 as CBS All Access. After the Viacom remerger in 2019, their Media Networks brands such Comedy Central. MTV, Nickelodeon and Paramount Pictures were integrated into CBS All Access. In 2021, the P+ was rolled out in 25 markets including Latin America, Canada and Australia. In 2022, they plan to launch in the UK and South Korea. With further launches planned in Italy, France, Germany, Switzerland and Austria.

As of their Q1 earnings report, P+ generated 6.8 million in new subscribers which was above expectations. Currently they have just under 40 million paid subscribers, and have plans to reach 75 million by 2024. To put this into perspective the market leader in streaming Netflix (NFLX) has 221.6 million subscribers, while Disney+ has 137 million subscribers. Now although Paramount is late entering the “steaming wars” but due to the low cost nature of these streaming services, it would not be unsurprising for households to subscribe to multiple services. These would act like “television channels” and means we have come full circle! Paramounts differentiated and Iconic “content is king” is appealing (who doesn’t love the Godfather) and thus I believe subscriber growth will continue inline with their recent figures.

viacom-cbs-streaming

The company also owns Pluto TV, which they acquired in 2019. This service added 3.1 million Monthly Active Users (MAUs) in the quarter, bringing their total to over 68 million. They specialize in free, ad-supported streaming services (FAST) which gives Paramount a range of distribution methods appealing to different audiences.

This service generated close to $1B in revenue, which is a 1400% increase over the past 3 years. Paramount also has a major opportunity to expand into India and offer their service to the growing middle class population. CEO Bob Bakish stated in Q1 earnings: “we’re going to enter India in 2023, in a very capital-efficient, hard-bundled way”. They are aiming for IPL (Cricket rights) but will enter either way.

Stable Financials

Paramount Global generated $28 billion in revenue as of Q421, up ~12% YoY. Gross profit came in at $10.8 billion, + 5% YoY. While operating income dips slightly to $4 billion, down 16%.

As of Q1, total revenue was $7.32 which represented a 1% decrease year over year, due to a decline in advertising and licensing revenues.

- Adjusted OIBDA declined 44% from the prior year’s quarter to $913 million.

- Selling, general and administrative expenses increased 13.9% year over year to $1.61 billion.

According to their Q1 earnings call (Page 8). Paramount+ segment saw strong revenue growth, up 150% to $585 million, with domestic and international ARPU both higher quarter-over-quarter and year-over-year

As a media business the company operates with a healthy 35% gross margin and ~14% operating margin. The company ended Q1 with $5.3 billion of cash and total debt of $16.8 billion. This is fairly high debt but not surprising for a mature company. In terms of valuation, the GF Value line which analyzes historic multiples indicated the stock was “modestly undervalued” with pre market trading was priced in, the stock is now “fairly valued”. The stock also trades at a EV to EBITDA multiple of just 5,.4 which is at a similar level to Netflix (EV to EBITDA = 4.68) after their recent decline. While Disney is much more expensive with an EV to EBITDA = 22.9.

Final Thoughts

Paramount Global is a tremendous company, with a strong competitive advantage thanks to their Iconic movie selection. They are also leaders in Network TV across a variety of platforms and have strong growth plans for the future. The stock is undervalued relative to historic multiples and trades close to “cheap” competitors such as Netflix and thus it’s no surprise Buffett loaded up on shares in Q12022.