What is Value Investing?

Value Investing is an investing strategy categorised by two aspects, the first is finding the “Intrinsic Value” of a stock or asset, then the second is aiming to buy below that “intrinsic value”.

There is also “Deep Value investing” which entails buying a stock for below it’s net asset value “net-nets” popularised by the Father of Value Investing Benjamin Graham, Warren Buffett’s former professor, whom wrote the famous book “The Intelligent Investor”.

Value Investing correlates most with traditional business logic. The Idea is simply to “buy cash flows cheaply” or “buy one dollar for 50 cents” as Warren Buffett would say.

“All Investing is Value Investing, who wants to pay more for something than it’s worth” – Charlie Munger (Billionaire Value Investor)

What is the Value of a Stock?

A stock is just a share of a company, thus the value of the company is present value of the companies future cash flows.

As the old saying goes “A bird in the hand is worth two in the bush”. Thus cash in hand today is more valuable than “promised” cash in the future. This is because of uncertainty/risk to cash flows, in addition to inflation & opportunity cost.

1. Benjamin Graham

Benjamin Graham (1894- 1976) is known as the “Father of Value Investing” as he pioneered the strategies of deep value investing.

Graham wrote the book the intelligent investor of which his prodigy the Legendary Warren Buffett widely cites as the “best investing book ever written”.

Warren Buffett studied under Benjamin Graham at Columbia University and was his top student (no surprise).

Benjamin Graham averaged a compounded return of approximately 20% annually between 1936 to 1956. During the same period the general market returned just 12.2% annually on average.

Benjamin Graham Investing strategy

Benjamin Graham’s deep value investment strategies although simple were game-changing for those who adopted them, concepts include:

- Recognising a Stock is a portion of a Business

- Margin of Safety (Valuing a company then buying below than fair value)

- Mr Market (The concept that the Market is governed by a bipolar person which fluctuates from Fear to Greed)

- Deep Value Investing.

Deep Value investing generally involves looking for “Net Nets” a stock selling for a price below its net current asset value (NCAV).

Fun Fact: A series of unfortunate events led to Buffett’s encounter with Graham. As one of the richest people on this planet was TURNED DOWN by Harvard Business school in 1950.

Buffett stated: “I spent 10 minutes with the Harvard alumnus who was doing the interview, and he assessed my capabilities & turned me down,”

Benjamin Graham Quotes Gallery

2. Warren Buffett

Warren Buffett is the greatest investing legend of all time & a wealthy billionaire.

He is the epitome of a classic Value investor. Valuing Companies not stocks, with an extremely disciplined approach to his trades. His strategy focuses on risk minimisation & long term investing gains.

This has paid of substantially with an annualised compounded portfolio return of approximately 20% since 1964, for his investing conglomerate Berkshire Hathaway.

Overall returns from 1964 to 2021 = 2,855% (approximately).

Fun Fact: If you invested $1000 in 1964 into Berkshire, that would be worth an incredible $28,855. Close to a 29X Return!

Buffett studied at Columbia University under Benjamin Graham (The father of value investing) who authored the bible of investing, the Intelligent investor & Security Analysis.

Warren Buffett Quotes (8). You can use this image if credit with clickable link: www.Motivation2invest.com/Warren-Buffett-Quotes

“Be Fearful when others are greedy and greedy when others are fearful” this is another way of saying

observe the masses and the do opposite. This is the essence of a contrarian investing strategy where you have to bet against the consensus but also be right.

This also encourages you to buy during a stock market crash when people are fearful (but stocks are cheaper!) and sell during speculation/greed when things are actually the most risky.

Warren Buffett Quotes Gallery

3. Charlie Munger

Charlie Munger is a famous Value Investor with a net worth of $2.2 Billion. Munger is an exceptional investor with great Witt, Wisdom & no filter when it comes to saying what he thinks!

Munger is also a great friend & Business partner of Warren Buffett. Buffett often jokes about himself & Munger knowing “what each other are thinking” like former Siamese Twins & they used speak on the phone almost daily.

Munger is credited to have helped Warren Buffett invest into “Wonderful companies at fair prices”, rather than just deep value investments, using the Benjamin Graham method.

Buffett had traditionally done cigar butt strategy investing, where he looked to buy companies trading below net asset value, with “one last puff” in them.

Charlie Munger Quote “Happiness quote” Copyright: Motivation2invest.com Youtube (Credit if used) https://www.youtube.com/c/Motivation2Invest/videos

Warren Buffett and Charlie Munger first met in 1959.

The famous investors were introduced to each other at a dinner, with the referral coming from a popular family doctor of in Omaha.

The story is Legendary, In 1957 Doctor Edwin Davis had a meeting with Buffett and agreed to allow him to manage his money…because he reminded him of someone named “Charlie Munger.”

In a CNBC Interview, Buffett stated:

“Well, I don’t know who Charlie Munger is, but I like him”

Charlie Munger Quotes Gallery

4. Joel Greenblatt

Joel Greenblatt is a legendary Value investor with a net worth of approximately $500 Million. Joel is a classic value investor and is style has been widely influenced by the teachings of Benjamin Graham and Warren Buffett.

Legendary Value Investor Joel Greenblatt giving an example for why he is a value investor, paraphrasing his quote below:

” If you were buying a house would you buy a house which has recently gone up in price & is thus more expensive (that is momentum investing) or would

you quantify the cash flows from rental income & aim to buy a house which was relatively cheaper than similar ones in the area…that is value investing. “

Joel Greenblatt Quotes Magic Formula for Investing. Credit: www.Motivation2invest.com/Joel-Greenblatt-Quotes

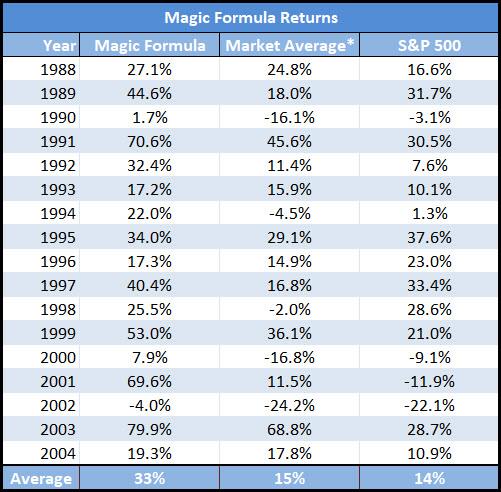

Magic Formula?

Joel Greenblatt’s Magic Formula is a quantitative method of investing into the stock market. The Magic Formula was popularised in his best selling investment book “The Little Book which beats the market”.

The formula works by screening for stocks with a low Price to earnings ratio (P/E) but also high returns on capital. Generally these two metrics offer a simplified method of buying “cheap stocks of good companies”.

Here is how the Magic Formula works:

1. Screen Stocks for Low P/E Ratio and High Returns on Capital (For example P/E Ratio less than 10, and Return on capital above 15%.)

2. Buy the top 20 of these stocks for diversification

3. Hold for one year (no matter what)

4. Then sell and repeat back to step 1.

Joel Greenblatt Quotes Gallery

5. Michael Burry

Michael Burry “Big Short” is a legendary contrarian investor, he is most famous for predicting the housing bubble of 2007 and subsequent financial crisis of 2008.

Burry’s Hedge Fund opened a “Big Short” position against the US Housing market, betting that it would fall. This contrarian bet paid off for his investors & was popularised in the Oscar winning movie “the Big Short” where Michael Burry was played by Christian Bale.

Michael Burry quotes motivation 2 invest (11)

More recently Burry has opened major short positions against stocks like Tesla and Cathie Woods Ark Invest. See Michael Burry | What stocks has he been shorting?

Burry has long put’s against 800,100 shares of Tesla worth approximately $534 million, according to a filing with the U.S. Securities and Exchange Commission.

Fun Fact: Michael Burry is a qualified medical doctor and also has a glass eye! For more see: 8 Unbelievable Facts about Big Shorts Michael Burry

Michael Burry Quotes Gallery

6. Seth Klarman

Seth Klarman is a legendary Value Investor nicknamed the “next Warren Buffett”. Klarman follows many of the traditional philosophies of Warren Buffett such as investing within his “circle of competence” and using a “Margin of Safety”.

He even wrote a book on the subject. Now Seth Klarman runs the Baupost group which focuses on traditional value investing with a few advanced investing techniques.

Seth Klarman Value Investor quotes (19) Credit. www.motivation2invest.com/seth-klarman-quotes

“When you adopt a value investing mindset, any other investment type feels like gambling” – Seth Klarman (Value investor) .

Value investing is simple to understand but hard to implement long term. You are basically looking Value a company (a stock is a portion of a company) , then buy below fair value ideally with a margin of safety.

This sounds simple however, many people (even intuitional investors) don’t value stocks and instead invest using momentum (what has gone up recently) and from news etc. That is the reason Seth Klarman says other strategies feel alot like gambling.

Seth Klarman Quotes Gallery

7. Sir John Templeton

Sir John Templeton (1912-2008) is one of the greatest Value investors in history. Templeton is most famous for making bold bets against the consensus and being right!

The Ultimate Contrarian (World War 2) Investment:

An extreme example of this includes a bold investment during World War 2!

In 1939, WW2 was just beginning and the stock market crashed as most people were in fear (understandably).

However, Templeton saw this volatility as an opportunity.

John Templeton MOTIVATION 2 INVEST Quotes (1) Credit: www.Motivation2invest.com/John-Templeton-Quotes

Templeton borrowed thousands to buy 100 shares of EVERY STOCK selling for less than one dollar, during Stock Market Crash.

At that point one third of the companies faced bankruptcy, but he held his shares firm. After which all but four stocks rebounded, which made him an incredible 400% return in just 4 years!

John Templeton Quotes Gallery

8. Mohnish Pabrai

Mohnish Pabrai is a legendary deep value investor. His strategy focuses on medium risk , high return bets.

Pabrai is one of the few Legendary investors who invests into volatile small cap stocks which offer greater potential for returns.

These include “10 Bagger stocks” , these are stocks which can earn 10 times your money!

Mohnish Pabrai Quotes Motivation 2 invest . Credit: www.Motivation2invest.com/Mohnish-Pabrai

Pabrai is also a contrarian investor who likes to “fish where others aren’t fishing” and bet against the crowd.

He does this by investing into emerging markets and areas which seem to be of higher risk such as India and Turkey.

In his book, Pabrai calls his investing Strategy the “dhandho” which is derived from Sanskrit word Dhana which means “endeavors that create wealth”.

In Mohnish Pabrai’s own words he looks for “no brainer opportunities for high investment returns.”

Fun Fact: Mohnish is widely influenced by the investment strategy of Warren Buffett and Charlie Munger, whom he is now good friends with after winning an auction for charity meal with Buffett many years ago.

Mohnish Pabrai Quotes Gallery

9. Walter Schloss

Walter Schloss (1916 to 2012) was one of the greatest value investors in History. As a known disciple of Benjamin Graham, Schloss focused on deep value investing.

Schloss took Ben Graham’s investment courses before going to work for him at the Graham-Newman Partnership, there he met Warren Buffett.

In 1955, Walter Schloss started his own fund and for over 45 years he delivered his investors incredible annual returns of 15.3% versus 10% for the S&P 500.

In 1984, Warren Buffett named him as one of the Superinvestors of Graham-and-Doddsville.

Warren Buffett stated about Walters Schloss:

“He knows how to identify securities that sell at considerably less than their value to a private owner; And that’s all he does …

He owns many more stocks than I do and is far less interested in the underlying nature of the business; I don’t seem to have very much influence on Walter.

That is one of his strengths; No one has much influence on him.”

Walter Schloss closed his fund in the year 2000 and passed away at the age of 95 in February 2012.

Walter Schloss Quotes Gallery

10. Howard Marks

Howard Marks is a legendary Value investor with a specialism in deep value investing & special situations, such as credit & distressed debt investing. Marks is the founder of Oak Tree Capital .

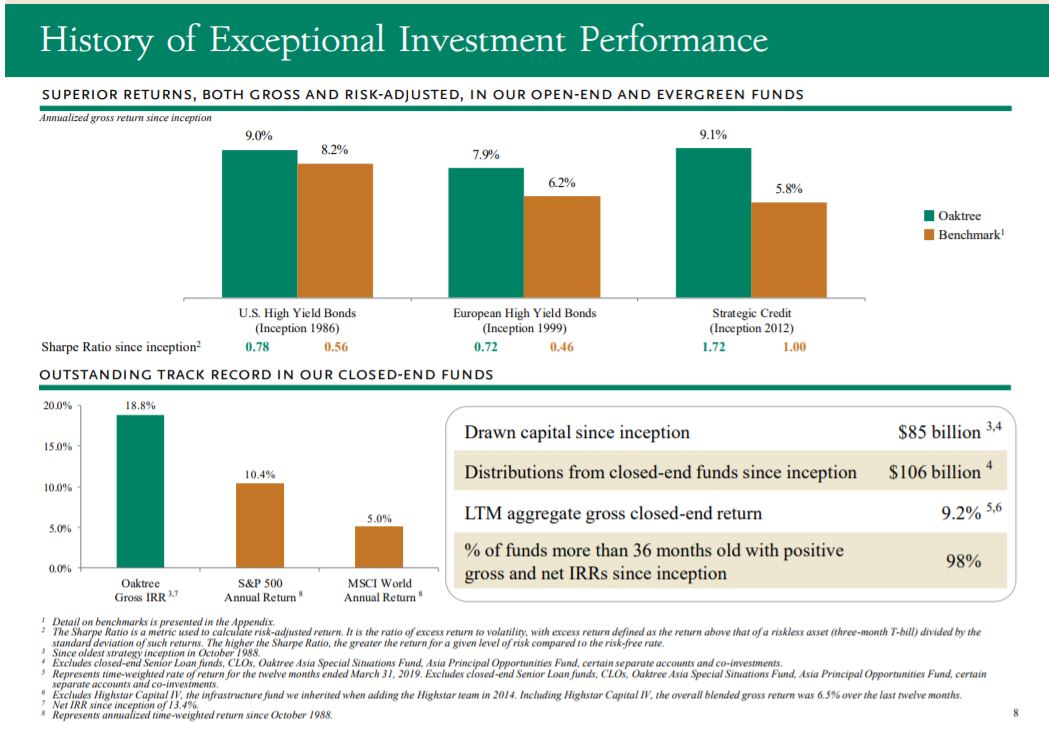

Investment performance

Howard Marks Oaktree capital has a history of exceptional performance. 18.8% IRR (Internal Rate of Return) vs the S&P 500 Annual Return of 10.4%. This is the annualised time weighted return since October 1988.

Mastering the Market Cycle Howard Marks

Howard Marks believes everything is governed by cycles, from investor moods to stock market crashes.

Howard Marks even wrote a best selling book on the subject called “Mastering the Market Cycle” & “the most important thing”. The later book lists “the most important things” to do when investing.

Howard Marks Quotes Gallery

11. David Dodd

David Dodd (1895 to 1988) is a legendary Value investor, who was one of Warren Buffett’s Super Investors of Graham & Doddsville!

Dodd was a colleague of Benjamin Graham at Columbia Business School and together they wrote the bible of deep value investing “Security Analysis” in 1934.

David Dodd focuses on Deep Value Investing which involves buying assets below their intrinsic value with a Margin of Safety. The strategy also involves looking for “Net-Nets” these are stocks trading below their net asset value.

How Buffett Met David Dodd?

In 1950, Warren Buffett was turned down from Harvard Business School (the Irony)

Buffett quoted:

“I spent 10 minutes with the Harvard alumnus who was doing the interview, he assessed my capabilities and turned me down.”

Luckily for Buffett he discovered that Benjamin Graham & David Dodd were teaching at Columbia Business School. Having read their books “Security Analysis” & “The Intelligent Investor” cover to cover multiple times.

Buffett called them up “I thought you guys were dead, but if not I would love to come and study at Columbia” . Buffett was their greatest student & top of the class (no surprise)

David Dodd Quotes Gallery

12. Bill Ruane

Bill Ruane (1925 to 2005) is a famous & historical Value investor who was one of Warren Buffett’s Superinvestors of Graham-and-Doddsville.

When Buffett closed his original fund in 1969 he even referred his investors to Bill Ruane’s Sequoia Fund, this is the ultimate referral!

Bill Ruane’s fund had a Value based strategy of buying “Wonderful Businesses at fair prices” , rather than the strict Ben Graham approach of “Cigar Butt” style, deep value investing.

Bill Ruane Quotes Gallery

Is Value Investing Dead?

Value investing has UNDERPERFORMED growth stock investing over the past decade which has lead many people to say “Value Investing is dead”. However in 70 years prior Value has OUTPERFORMED growth stock investing strategies.

Thus Value Investing has a greater track record of outperformance historically and as a strategy is as timeless as common sense and thus not dead. The fact that Value has underperformed growth over the past 10 years, has led some people to believe this is a systematic change, only time will tell.

Read the Full Study here: Is Value Investing Dead?

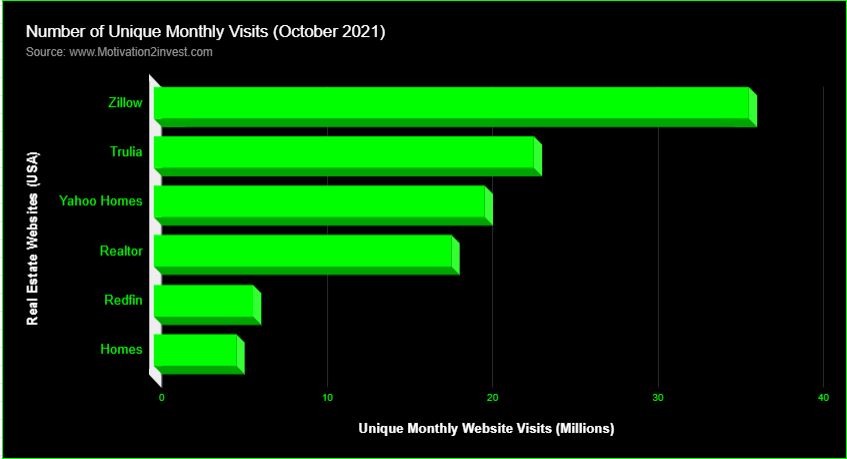

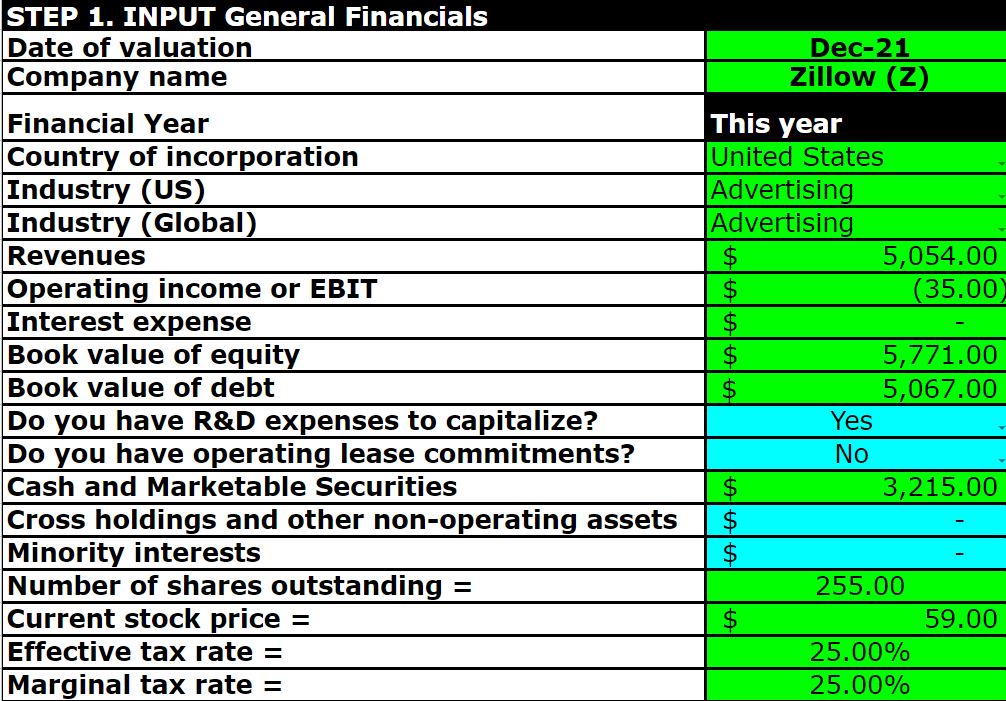

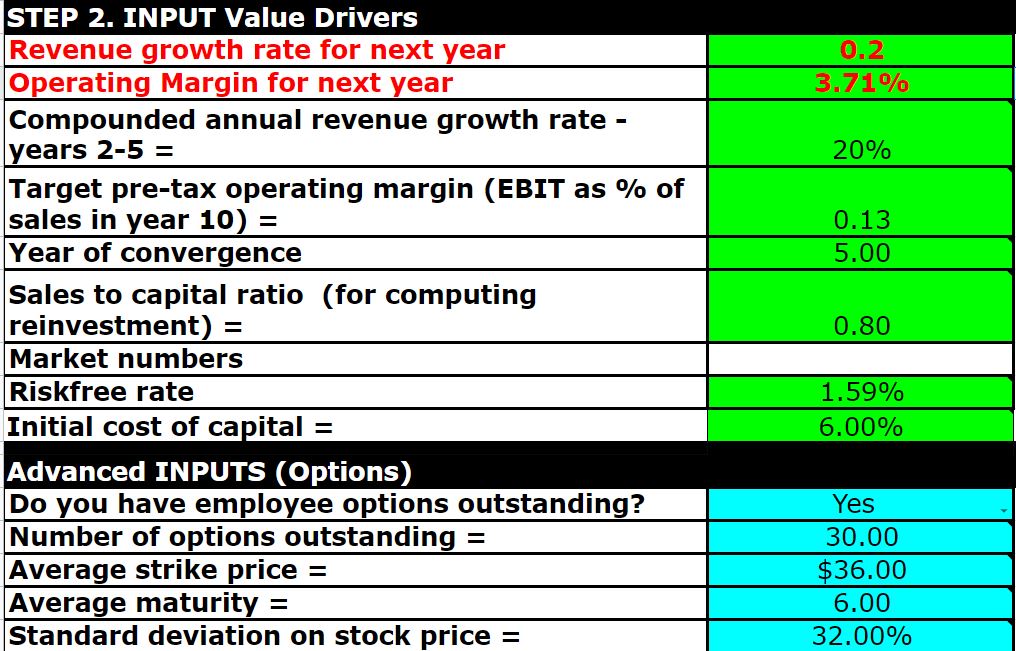

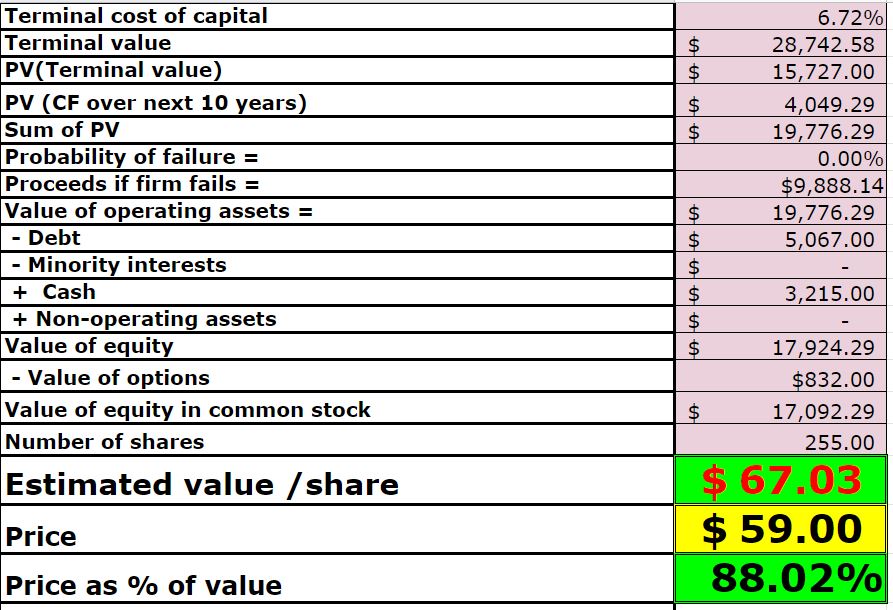

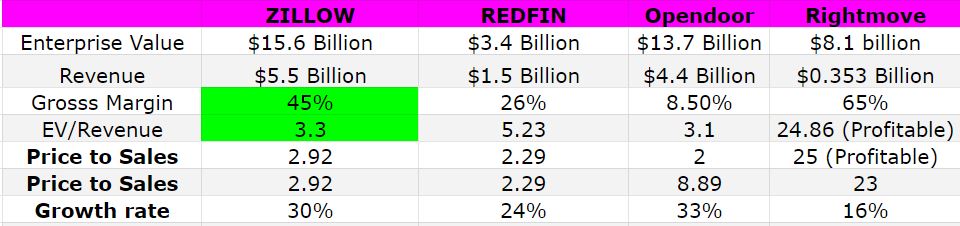

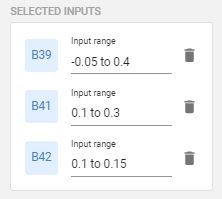

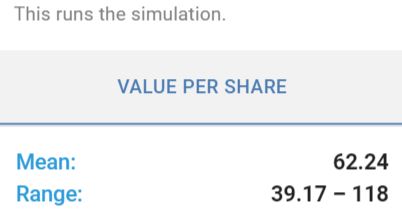

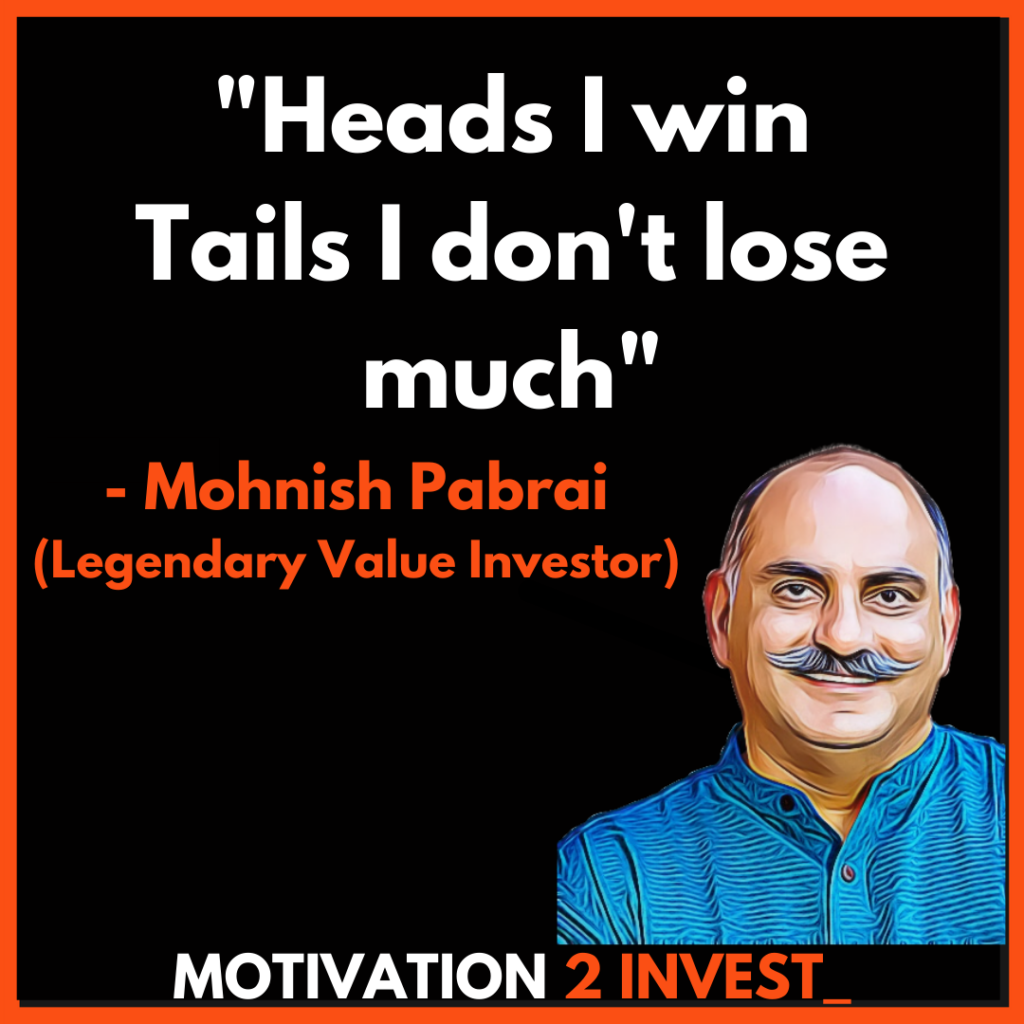

Zillow Stock Valuation Gallery

Zillow Stock is primed for Value Investors after a recent decline, review our gallery below to find out whether the stock is undervalued, from our advanced valuation model. This is not financial advice.