What kind of Investor is Howard Marks?

Howard Marks is a legendary Value investor with a specialism ib deep value investing & special situations, such as credit & distressed debt investing. Marks is the founder of Oak Tree Capital which lists four kinds of investing on their website:

- Credit (Loans/debt etc)

- Real Assets (Real Estate)

- Private Equity (Special Situations)

- Listed Equities (Emerging markets & Value Stocks).

Howard Marks believes everything is governed by cycles, from investor moods to stock market crashes.

He even wrote a best selling book on the subject called “Mastering the Market Cycle” & “the most important thing”. The later book lists “the most important things” to do when investing.

Investing Strategy: Value Investor, Contrarian, Small Cap, Large Cap

How did Howard Marks make his Money?

Howard Marks began his Career at Citibank, where he started a portfolio of high yield bonds, upon meeting with “junk bond king” Michael Milken.

After he became an asset Manager at TCW, there he met his future co founder for Oaktree (Bruce Karsh). In 1995, Marks left with other other colleagues to start Oaktree Capital.

In 2019, Brookfield Asset Management acquired 61% of Oaktree capital for approximately $4.9 Billion in cash & stock.

Howard Marks Letters/Memos:

Howard Marks Memo’s at Oaktree capital are world renowned and even read by legendary investors such as Warren Buffett!

A widely popular memo is called “something of value” In the memo he talks about what is Value investing, the works of Benjamin Graham, Value vs Growth Investing etc. The Memo by Howard Marks is also a popular podcast and Oaktree insights are a great way of exploring the investing strategy of Howard Marks at an advanced level.

Oaktree Capital Fund Performance:

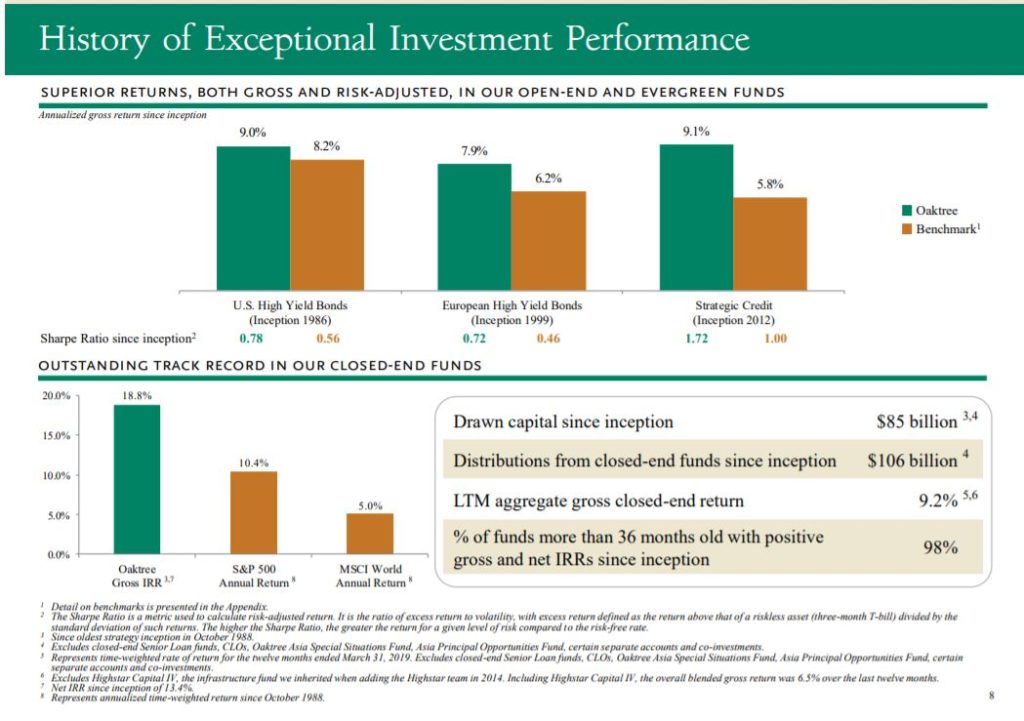

Howard Marks Oaktree capital has a history of exceptional performance. 18.8% IRR (Internal Rate of Return) vs the S&P 500 Annual Return of 10.4%. This is the annualised time weighted return since October 1988. More details can be downloaded at Oaktree Capital.

Howard Marks Oaktree capital performance Historic. 18.8% IRR (Internal Rate of Return) vs the S&P 500 Annual Return of 10.4%. Courtesy of: Oaktreecapital.com

Howard Marks on Bitcoin

Legendary Investor Howard Marks was previously sceptical on Bitcoin & Cryptocurrencies and stated in 2017 “they have no intrinsic value”. However, his thinking has evolved mainly thanks to influences from his son.

In 2021, at the Global distribution conference , Howard Marks stated:

“My Reaction to Bitcoin in 2017 when it jumped from $1000 to $20,000…was a knee jerk sceptical reaction to something new…because of it’s newness”

“My son & I lived together during the pandemic, he gave me a lecture every day that i had opined about Bitcoin without knowing what I was talking about…which was certainly true”

Marks goes onto say:

“Most people have accepted you can make 7% returns dependently from stocks & bonds, so that means you have to push out the risk curve and go further a field into new things or odd things”

Howard Marks 15 Quotes on Investing

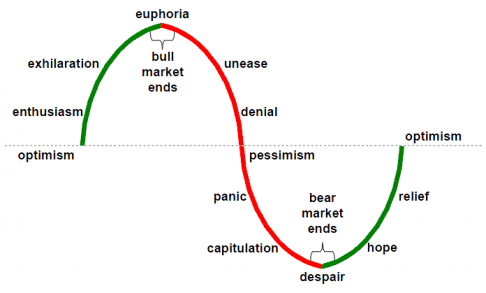

1. The market moves in cycles…

Credit: www.Motivation2invest.com/Howard-Marks

“The Market Moves in cycles like a pendulum which swings from pessimism to optimism”. As the father of value investing Benjamin Graham once stated, in the short term the stock market is a voting machine based on popularity, fear & greed, but in the long term the stock market is a weighing machine based upon fundamentals.

Stock Market Moves in Cycles from fear to greed

2. Buy from the pessimists, sell to the optimists…

MOTIVATION 2 INVEST Quotes – Credit: www.Motivation2invest.com/Howard-Marks

“The Market moves in cycles, buy from the pessimists and sell to the optimists” , This is very similar to a quote by Sir John Templeton a legendary contrarian investor.

He stated it’s best to be a “realist” and then as Marks stated also…sell to the optimists at sky high valuations and “buy from the pessimists” at low valuations.

3. “People should like something less when the price rises…”

Howard Marks Quotes Motivation 2 invest Credit: www.Motivation2invest.com/Howard-Marks

“People should like something less when the price rises, but they often like it more! ” This is a strange but common phenomenon which shows humans aren’t rational and have a “heard mentality” in general.

When the price of a stock or asset such as cryptocurrency rises, suddenly more people get interested. This is despite the logical fact that as the price of the security suddenly rises, so does the risk as the valuation is usually stretched.

4. “What a wise man does in the beginning…”

MOTIVATION 2 INVEST Quotes – Credit: www.Motivation2invest.com/Howard-Marks

“What a wise man does in the beginning…the fool does in the end” .

Every stock market bubble starts with a nugget of truth from the California Gold Rush, to the dot com bubble in the late 90’s, Housing bubble 2008 etc.

There was lots of gold in California, the internet was a great technology and housing were a fairly “safe” investment.

However, “what the wise man does in the beginning”, investing into these asset classes at low valuations…”the fool does in the end”. The “fool” is usually the general retail investor, but can also be large intuitions, who can’t stand watching their colleagues make money and thus succumb to “FOMO” (Fear of missing out).

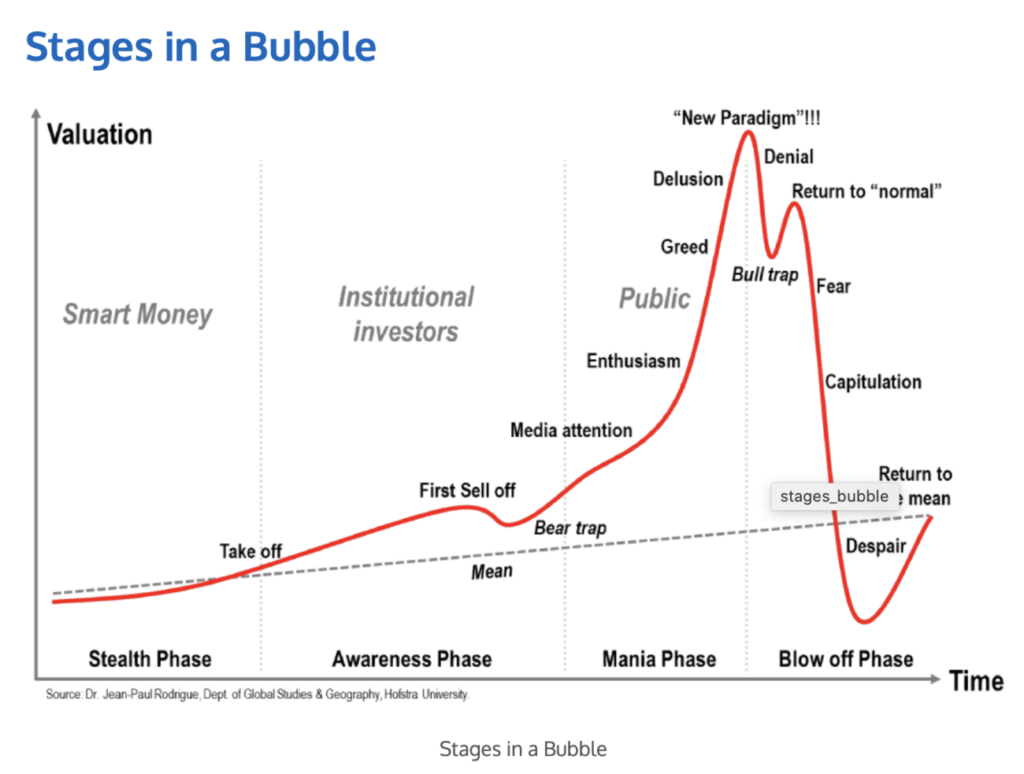

Stock Market Bubble chart.

From the chart of a bubble above you can see the various stages, it starts with the “Stealth Phase” where the “smart money” has a unique insight and thus decides to invest.

Then we go to the Awareness phase and majority of large institutional investors come in. Then the general public see’s a spike in trading volume and all this “smart” and “large” investors piling into the stock or asset.

Your friend in the office then walks in and brags of how much money he made in a few days…you then invest also. Then after capitulation…

“FOMO” fear of missing out, is one of the main causes of bubbles from the dot com bubble in the late 90’s to the housing bubble in 2008.

Cryptocurrency was a bubble back in 2016, which rose suddenly then popped. But only time will tell whether it will be a bubble again…it does seem to follow many of the above characteristics.

5. “Success creates the seeds of failure”

MOTIVATION 2 INVEST Quotes -Credit: www.Motivation2invest.com/Howard-Marks

“Success creates the seeds of failure and failure creates the seeds of success” , When stock prices run up fast (as mentioned previously in the bubble explanation) euphoria is in the air, everyone is making money”…”on paper” and overconfidence ensues.

However, this is usually wear the seeds of failure are shown. Just like an overconfident driver, who gradually goes faster until the car ends up on it’s roof!

The only positive of this, is these “seeds of failure” a stock market crash for example, offer the opportunity as the pessimism often results in low valuations.

Legendary Growth stock investor Cathie Wood stated “The Greatest Bull Markets are built on walls of worry”

6. “We should know where we are”

Howard Marks Quotes Credit: www.Motivation2invest.com/Howard-Marks

“Although it’s hard to predict where we are going, we should know where we are”. Predicting a the next stock market crash is very difficult and almost impossible to do consistently. However, Howard Marks has some great advice, although we can’t predict where we are going…we should know where we are in the Market cycle.

7. “Two types of forecasters”

Howard Marks Investor Quotes

Credit: www.Motivation2invest.com/Howard-Marks

“There are two types of forecasters, those who don’t know and those who don’t know they don’t know” Howard Marks believes nobody can consistently predict the stock market crashes, interest rates, inflation etc.

The Legendary investor Peter Lynch also agrees with this. However, this doesn’t stop economists, hedge funds and many “experts” on CNBC trying.

8. “Success comes from buying things well”

Howard Marks Investor Quotes

Credit: www.Motivation2invest.com/Howard-Marks

“Success doesn’t come from buying good things, but buying things well”. This is a difficult concept for many people to understand, as when the see a “great company” they automatically think it is a great investment.

However, this is not always the case as a great investment depends upon the price paid. Howard Marks in a past interview offered the analogy of buying a car, if he offered to sell you his car you would first ask “what price?” .

Then if you are smart, you will compare the price to other similar car’s. However in stocks, many people still forget to even do “relative valuation”…this is comparing Price to sales (PS) ratio’s , PE ratio’s, EV/EBITDA etc.

9. “There are bold investors & old Investors…”

Howard Marks Investor Quotes

Credit: www.Motivation2invest.com/Howard-Marks

“There are bold investors & old Investors, but not any old bold investors”. This is very true if you take a look at many great investors they focus up limiting the downside risk first. However, many “bold investors” that use risky/speculative strategies with leverage can become successful. But if they don’t change their strategy usually they get wiped out.

Story of a “Bold Investor” who lost $20 billion in 2 days:

A great example of a “bold investor” in recent times was “Bill Hwang of Archegos Capital” . Bill came from humble beginnings working in McDonalds, before managing to start on Wall Street. He executed well and built up an incredible fortune of $20 billion.

In 2020, Hwang had a series of leveraged bets on tech stocks but when the market corrected he lost $20 billion in 2 days!

Bill even nearly took the Banks who borrowed him substantial amounts with him, including Morgan Stanley and Credit Suisse which lost $861 million!

10. “Luck plays a key part in any investing outcome…”

Howard Marks Investor Quotes

Credit: www.Motivation2invest.com/Howard-Marks

“Luck plays a key part in any investing outcome, thus you can’t judge the quality of the decision by outcome alone”

In investing a “mistake” does not necessarily mean because the stock went down, as luck can play a part. However, you can learn from your “process” used to make the decision to buy or sell the security.

11. Remember the 6ft man who drowned in a lake that was 5 feet deep…on average.

Howard Marks Investor Quotes

Credit: www.Motivation2invest.com/Howard-Marks

“Averages are useless, a 6 foot tall man drowned in a lake that was 5 feet deep…on average” . Be aware of averages especially when predicting outcomes, we can easily say “on average” this will be fine.

However, in scenario analysis we should look at the “tail end” of the distribution, unlikely outcomes which are still possible, “black swans”. If these outcomes can be fatal then it’s best not to make that bet.

12. Probability & Outcome are different…

Howard Marks Investor Quotes

Credit: www.Motivation2invest.com/Howard-Marks

“Probability & outcome are different, probable things can fail to happen & improbable things happen all the time” Just because something is “improbable” doesn’t mean it can’t happen thus this should be taken in account in your investing analysis.

13. Make all big decisions on probabilities & impact

Howard Marks Investor Quotes

Credit: www.Motivation2invest.com/Howard-Marks

“Make all big decisions using probabilities & impact, best case, worst case & likely case” As mentioned previously it is all about analysing the distribution of outcomes, what is the best case, worst case and likely case”. Is the best case a 50x and the worst case losing 1x…if so this is likely a good bet.

But if the worst case is losing all your money….which may affect your lifestyle then it’s best not to take that bet. Of course, this is not financial advice.

Advanced investors use a “Montecarlo” distribution to highlight the range of possible outcomes. We offer this in our advanced valuation model if you wish to learn more.

14. “Investing is like Tennis…focus on not hitting losers”

Howard Marks Investor Quotes

Credit: www.Motivation2invest.com/Howard-Marks

Howard Marks gave a great analogy during a presentation at Google talks. He stated” investing is like Tennis, instead of trying to hit all winning power shots, focus on not hitting losers”.

He is referring to a useful strategy of beating amateurs at Tennis, as they are more likely to make a mistake, by trying to hit “power shots”. Which are much more difficult to execute.

This analogy reminds me of one by Warren Buffett, in which he stated they look for “one foot hurdles” to step over rather than trying to leap over 5 foot hurdles. In simpler terms this basically means looking for easy to understand businesses and simple “no brainer” investing opportunities.

15. “Experience is what you got…”

Howard Marks Investor Quotes

Credit: www.Motivation2invest.com/Howard-Marks

“Experience is what you got, when you didn’t get what you wanted” , things don’t always go to plan but the beauty with investing & life is we can reflect and learn from past mistakes.

Do you need help on your journey to financial freedom?

If you want to learn how to invest like the greatest investors of all time such as Warren Buffett, then check out our ultimate investing strategy course.

You also get access to our entire Stock research platform and our thriving VIP Membership group. Where you will be supported by like minded investors at all levels from complete beginner to advanced.

Membership is only open for a limited time only every month as we try to keep the quality high. As a special treat if you use the promo code “m2iinstagram10” you get $10 discount!