Tom Russo is a legendary Value investor, with a net worth of approximately $113 Million. Russo manages Gardner Russo & Gardner Holdings an investment firm with approximately $12 billion of assets under management.

Background

Tom Russo was born in 1955 and grew up in a small town called Titusville in Pennsylvania which was known as the birthplace of the oil industry.

In terms of education he achieved a history degree from Dartmouth College in 1977 and got business & law degrees from Stanford in 1984.

After which his investment education started, Russo joined Ruane, Cuniff & Goldfarb, where he worked on the Sequoia Fund. Then in 1989, he joined Gardner Investments (now Gardner Russo and Gardner) an investment firm which caters to high-net-worth individuals. There he manages the Semper Vic investment partnership.

Investment Strategy

Tom Russo has a strategy of Value Investing & Long term compounding. Russo went to a talk in 1982 at Stanford in which Warren Buffett discussed the power of long term compounding.

Russo’s investment strategy for picking stocks is as follows:

- Companies with strong cash-flow characteristics.

- Strong balance sheet

- History of producing high rates of return on their assets (ROC or ROE).

- Management Teams which invest for the future, without fear of the effect on short term profitability.

- Family Run/Founder Management Teams.

- Leading Global Consumer Brands which can grow into Emerging Markets which are increasingly becoming more stable politically.

Russo in a recent interview stated, “the challenge comes in finding these obviously desirable situations at reasonable or bargain prices.”

Long term investment Goal: 10% to 20% compounded return without great turnover of positions, thus minimising transaction fees and tax implications.

Investing Strategy: Value Investor, European, Emerging Markets.

Track Record:

Tom Russo’s investment firm, Gardner Russo & Gardner, beat the S&P 500 index by 4.7% annually between 1984 and 2011.

In 1989, Russo began investing in Weetabix Stock. The stock was trading at under £6 per share and was family controlled. Russo estimated that the stock was worth £13 per share (at least a double!).

Thus Russo started to buy heavy & ended up owning almost a fifth of the firm, after which he his stake sold to a private-equity group for a whopping £54 per share in 2003, nearly a 10x return!

Tom Russo Investing Quotes

1. Farm Don’t Hunt

Tom Russo Investing Legend Quotes. Credit: www.motivation2invest.com/Tom-Russo

“I think most people on Wall Street are hunters, i’m a farmer” – Tom Russo (Legendary Investor)

Farming is about planting seeds in the right reason and waiting long term to crop. The same goes for investing.

2. Invest Globally & Long Term

Tom Russo Investing Legend Quotes. Credit: www.motivation2invest.com/Tom-Russo

“Invest into Businesses globally and for at least 5 to 10 years” – Tom Russo

Many investors portfolios are overweight in stocks of their home country. The optimum portfolio diversification is based up the countries GDP relative to the world.

For example the US accounted for 15.9% of global gross domestic product (GDP) after which we have China, followed by Japan, Germany, India, UK, France. Thus this the ideal diversification portion.

3. Value Investing Strategy

Tom Russo Investing Legend Quotes. Credit: www.motivation2invest.com/Tom-Russo

This is great 4 point value investing strategy.

- Predictable Cash Flows

- Great Management

- Circle of Competence (Do you understand the business)

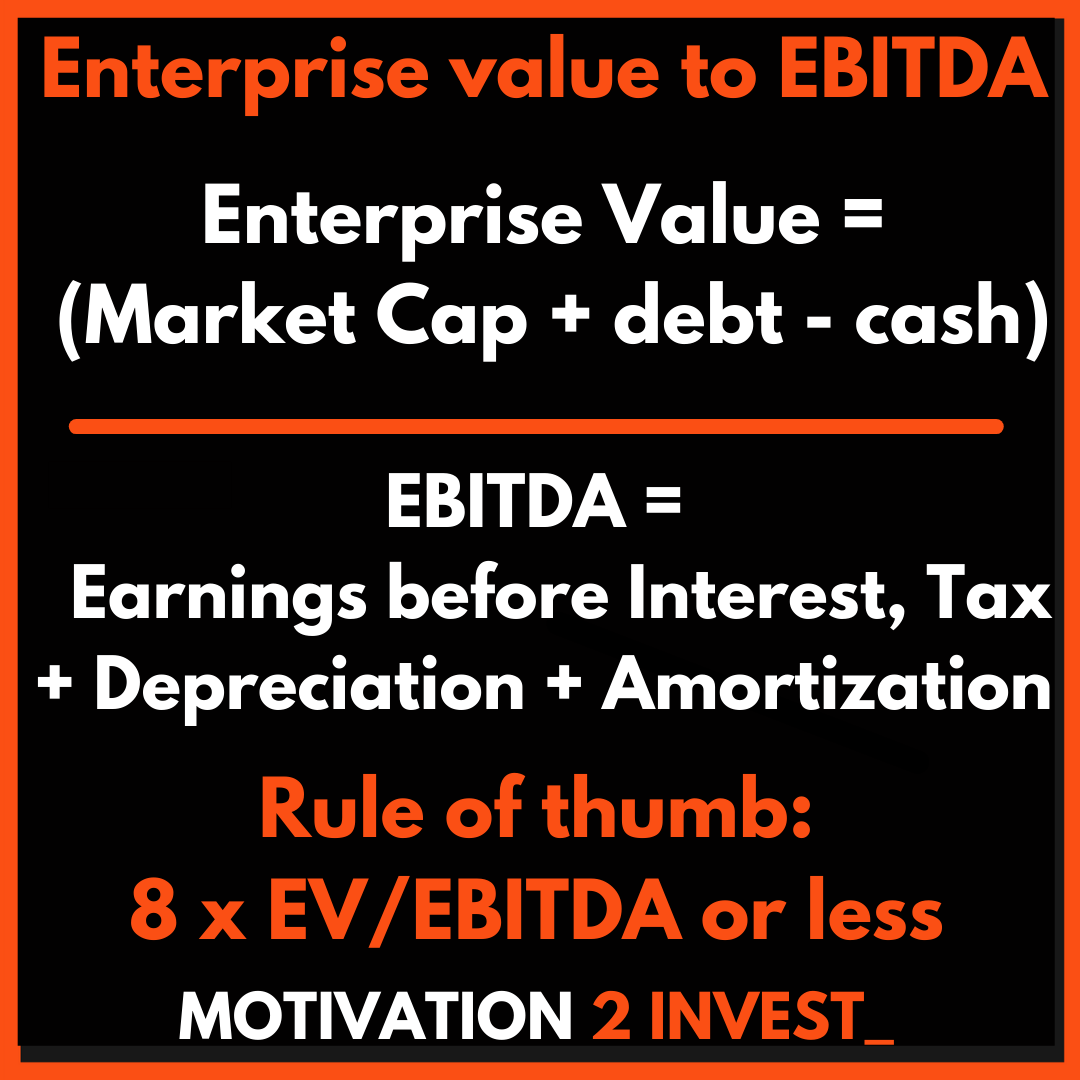

- 8 x EBITDA or less

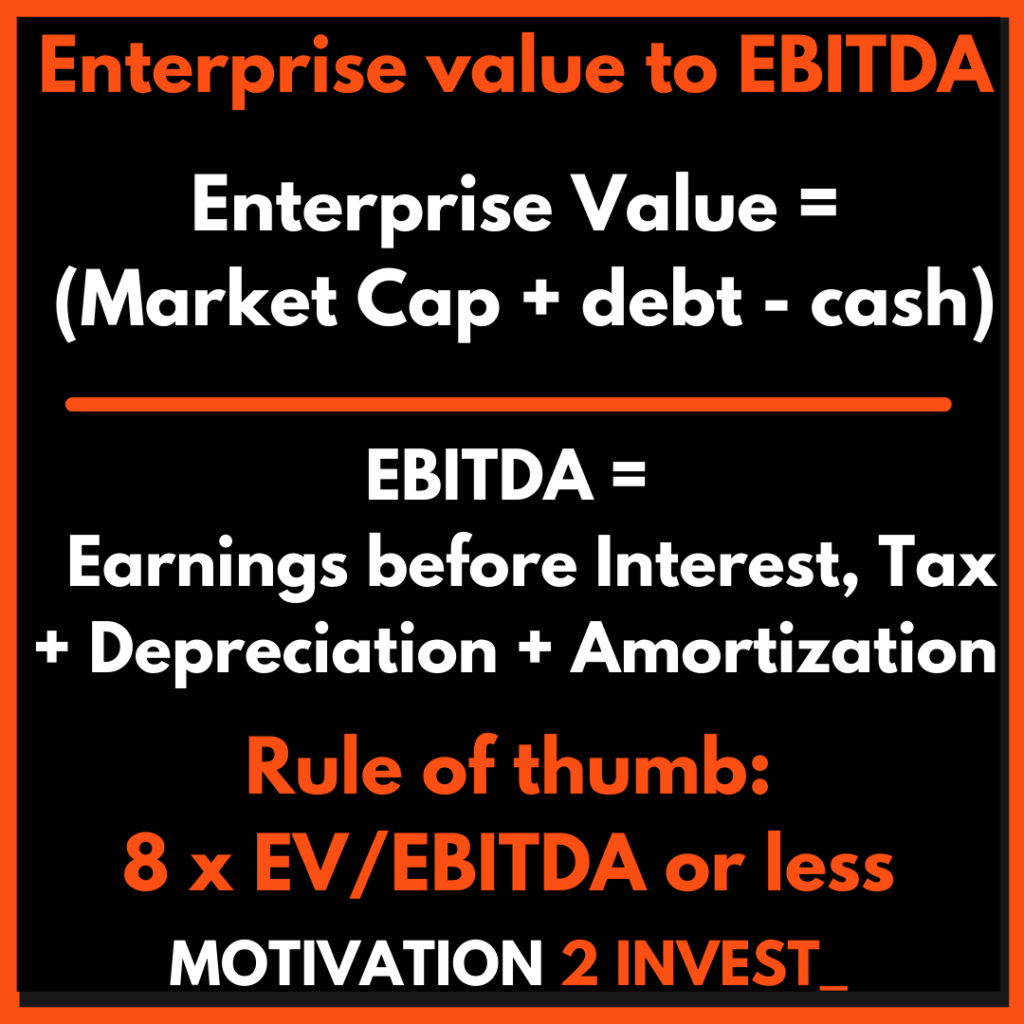

4. Enterprise Value to EBITDA

Tom Russo Investing Legend Quotes. Credit: www.motivation2invest.com/Tom-Russo

Enterprise Value to EBITDA is a ratio which can be used for relative valuation of stocks. You can compare the EV/EBITDA Ratio to other stocks in the same industry or historically on the same stock.

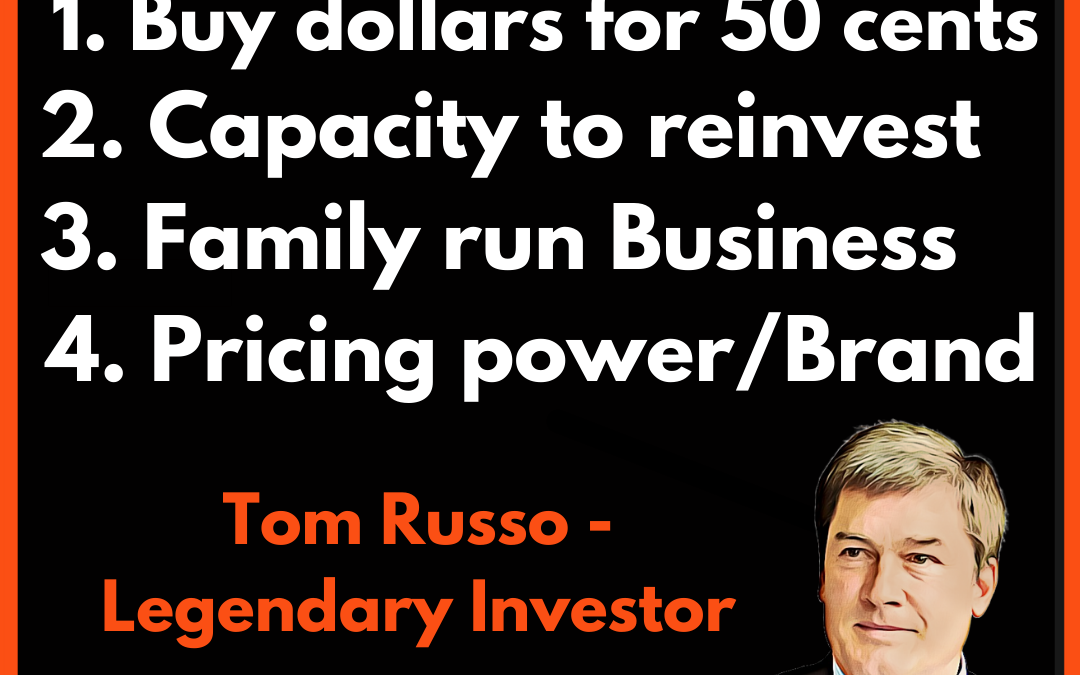

5. Buy Dollars for 50 Cents

Tom Russo Investing Legend Quotes. Credit: www.motivation2invest.com/Tom-Russo

True value investing founded upon the principles of Benjamin Graham and Walter Schloss involves aiming to purchase a dollar for 50 cents or buy cash flows cheaply. Here I have outlined part 2, of Tom Russo’s 4 part investment strategy.

- Buy Dollars for 50 cents

- Capacity to reinvest (High ROC >15% with opportunities/runway for growth

- Family Run Businesses (Similar to Nick Sleep)

- Pricing Power/Brand

Companies with strong Pricing power can raise there prices during times of inflation. These types of companies are great to invest into & hold long term.

Want to Learn how to invest?

If you want to learn how to invest like Warren Buffett but with a growth twist check out our: Investing Strategy Course

Places on our strategy course & in our stock research platform are open for a limited time each month, so click the blue links above to find out more now.

Tom Russo Investing Quotes Gallery