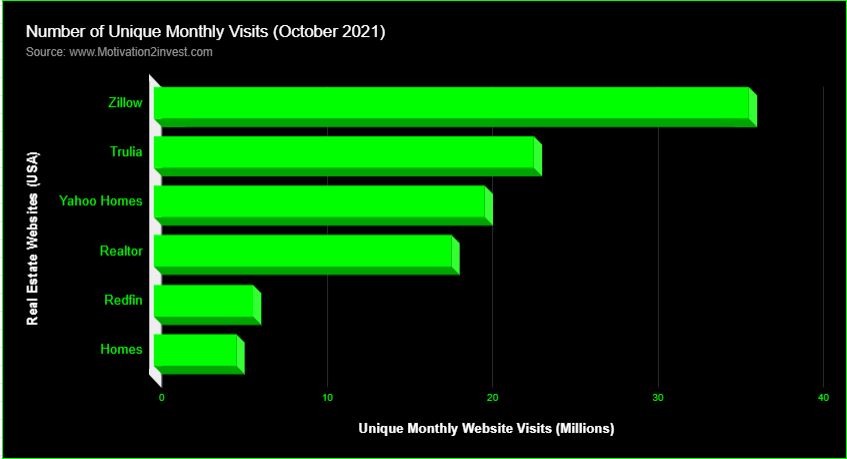

Zillow is the number one real estate platform in the US. They have over 227 Million Website visits per month which is approximately 80% of the US population (Some may be returning users etc) .

Zillow’s business model is really an advertising platform which offers home sellers and real estate agents the opportunity to list their properties for a fee. However, Zillow also has other aspects of the business such as Mortgages, Home Loans and until recently a home buying business.

Number of Unique Monthly Visits ZIllow, Created by Author at Motivation 2 Invest

Watch Full Video with Analysis below

Why has Zillow Exited the Home Buying Business?

Last year I noted on the channel Motivation 2 invest, Zillow was taking a risk with the “ibuying” business as it was low margin and hard to scale. It seems my prediction was correct.

Zillow CEO & Co Founder (Rich Barton) stated in their Q3 Earnings Call: “We couldn’t forecast future home prices, with our models” . He also noted a more subtle point that offering sellers low offers was potentially damaging the brand and only 10% of Zillow’s offers were actually accepted.

He also noted the inherent risk in this type of business which was unnecessary for Zillow which generally runs an “asset light business” model, website etc. The CEO noted they “took a big swing” and “failed fast”

11/01/2019 CNN Business Risk Takers: Zillow 347 Ardmore Court NW, Atlanta, GA ph: E. M. Pio Roda / CNN

They now have to lay off 25% of workforce.

Zillow will also report heavy Inventory losses to reported in Q4

and charges reported in first half of 2022. Totalling approximately $500 Million. The company still has around 7,000 homes to sell, but the CEO stated “this is not a fire sale and we are in no rush to sell the homes…they are appreciating assets” ….”But we are in a rush to get them renovated and back on the market”

They are expected to sell most homes by Q2 2022.

CFO Expects: “POSITIVE EARNINGS & POSITIVE CASH FLOW COMPANY AFTER

WIND DOWN”

You can download a PDF of their Q3 Earnings here. Zillow q3 earnings

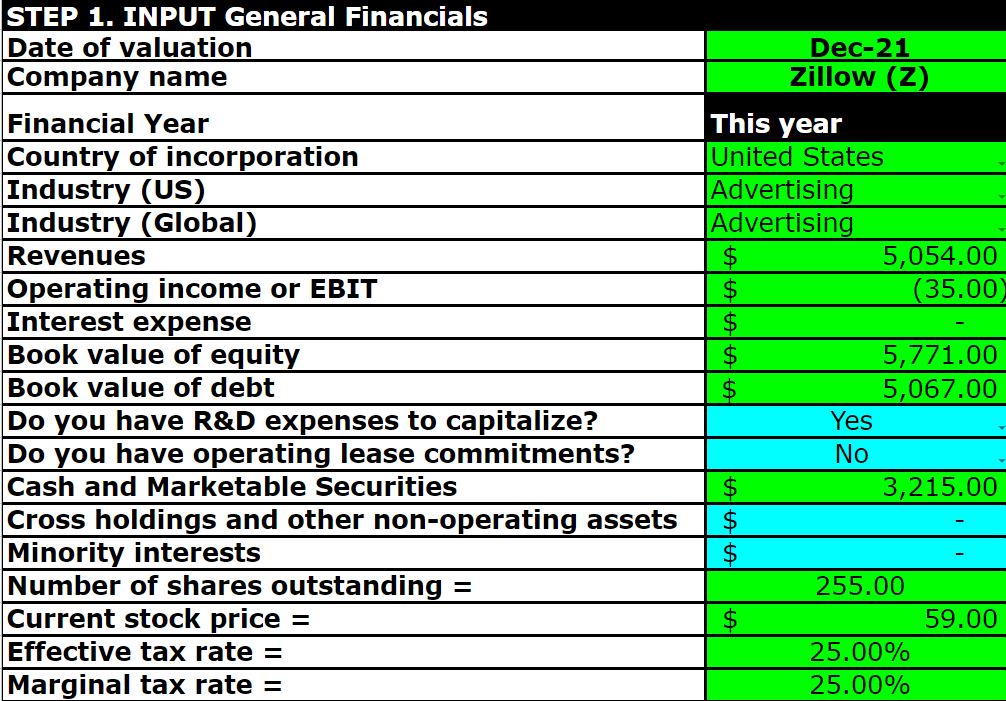

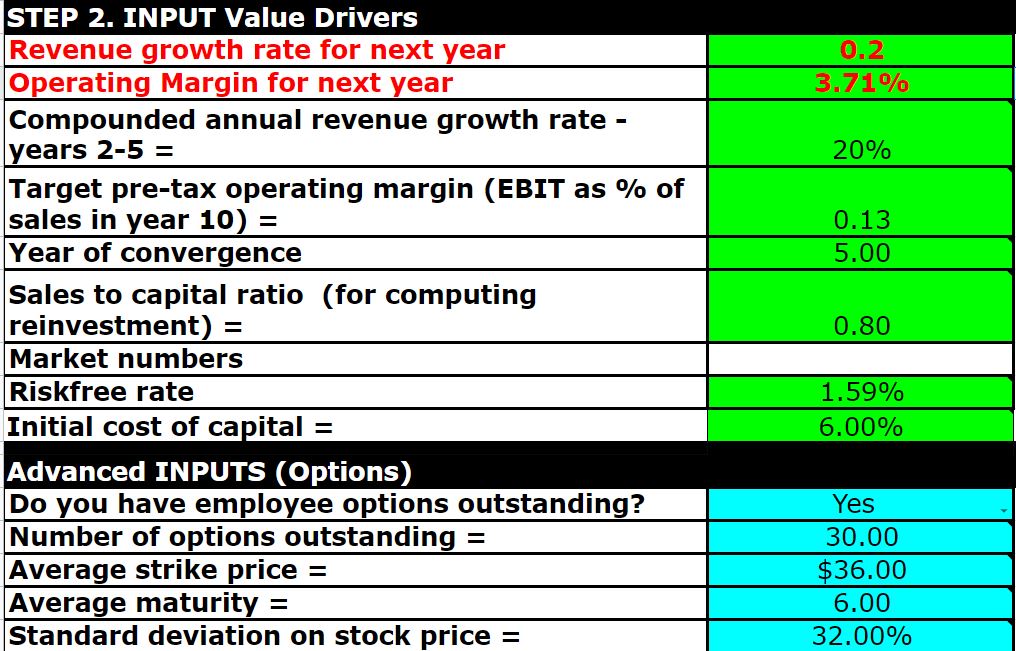

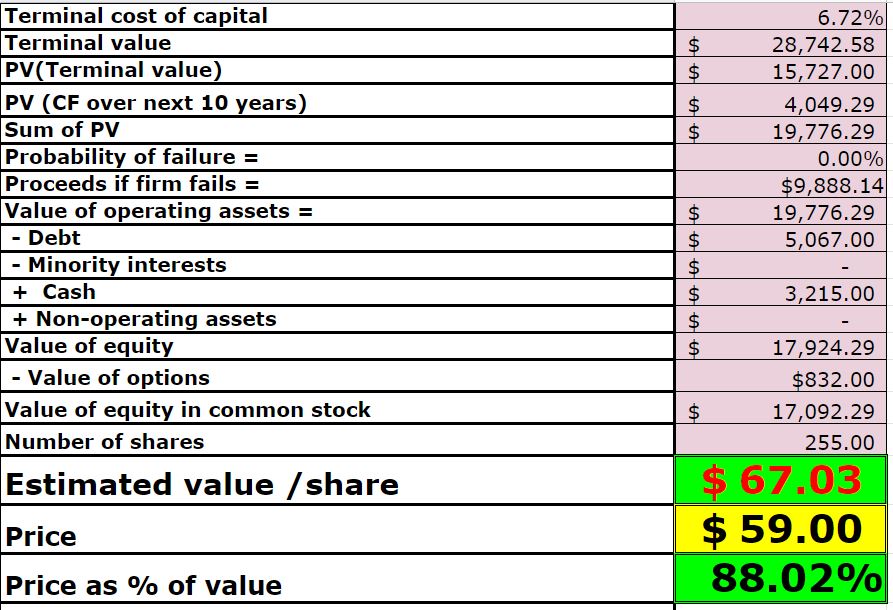

Advanced Valuation Model Zillow stock

They are working on Zillow 2.0 and Zillow 360′ (A inclusive home buying experience).

What is next for Zillow?

They also aim to become more involved into transactions.

According to their CFO “Zillow is only used for mid single digits as a percentage of total property transactions”

Thus they have a large potential market for growth.

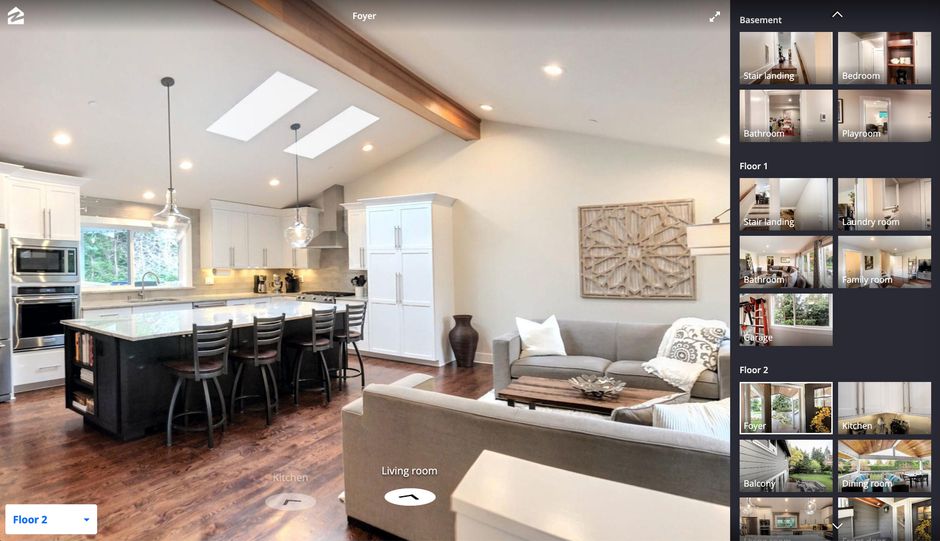

Zillow also plans to further develop their 3D homes, Virtual Reality and floor plans to improve the customer experience.

zillow-3d-home-interior. Screenshot by Stephen Shankland/CNET

ACQUISTION OF SHOWING TIME

Zillow Group acquired ShowingTime in February 2021 for $500 million. The transaction was successfully closed

Showing time is an Integrated Booking platform to help sellers organise viewing with buyers. This is a major pain point for many home sellers.

Zillow-Acquires-ShowingTime. Image by realtybiznews

CEO is Great Founder led | Good News

The Co Founder and CEO Rich Barton, founded the company 16 years ago. He is also the founder of Expedia & Glassdoor and is an experienced veteran, with great connections (on the board of Netflix). He is also the Largest individual Shareholder (Large insider holding/skin in the game). On a personal note, I admire their CEO’s Honesty and straight talking.

An investing strategy I have adopted recently is that of “Investing with great founders” . A Legendary Investor Nick Sleep has highlighted this in his Letters, Full Summary here: Nick Sleeps Letters

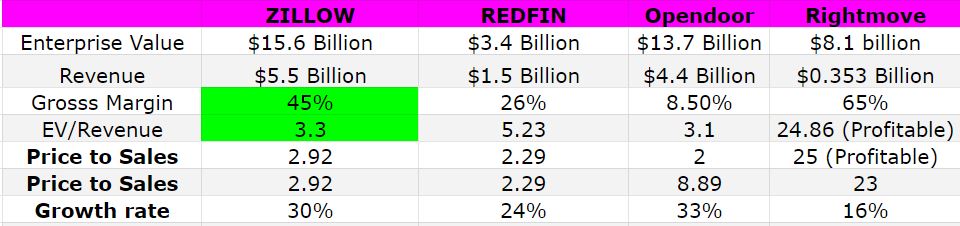

Is Zillow Stock Undervalued?

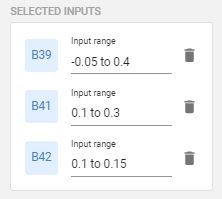

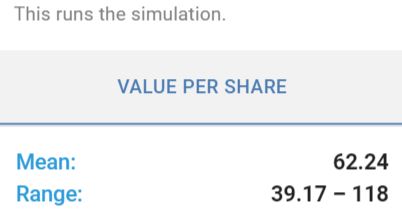

Advanced Valuation Model, Embedded Google Sheet. Scroll Down to see the financials. Click the page “Valuation Output” then scroll down to the orange/yellow section for the value per share.

Advanced Valuation Model Zillow stock

Advanced Valuation Model Zillow stock

Advanced Valuation Model Zillow stock

Advanced Valuation Model Zillow stock

Advanced Valuation Model Zillow stock

Zillow is facing headwinds from the exit of it’s home buying business, which is expected to last at least until the middle of 2022. However, they have made great progress moving this forward with over half of the homes having been sold or under contract to sell. On balance I believe this is the right decision by the CEO Rich Barton. Zillow is exiting a capital heavy business and can now focus more on their asset light online business model. Zillow’s core business has a high EBITDA margin (40%+) and thus focusing on improving their platform through technology seems like the best strategy. There is still a few questions which remain on exactly how Zillow will proceed with “Zillow 2.0” and capture a larger percentage of the property transaction market. There is also the risk the write down will take longer than expected.

However, from my Advanced valuation Model the Value of the stock is $69/share and thus is approximately 12% undervalued. Thus this could be a great long term investing opportunity, if you can handle the short term choppiness expected.