Top 10 Hedge Fund Quotes by David Tepper | Investing Strategy

David Tepper is one of the most successful hedge fund managers of all time, with a net worth of approximately $13 billion.

Tepper has an aggressive approach to investing & doesn’t mind sharing his bold opinions publicly. His Hedge Fund, Appaloosa mostly invests into distressed debt of companies close to bankruptcy.

This is very similar to another investing Legend: Howard Marks at Oaktree capital. Tepper was ranked the “Highest Earning Hedge Fund Manager” in 2012 with an estimated Salary of $2.2 Billion.

Fun Fact: Tepper’s Lucky Balls David Tepper keeps a brass replica of a pair of testicles on his desk which was a present from former employees. Tepper rubs the them for good luck during the trading day.

Fun Fact: David Tepper bought the Carolina Panthers in 2018. The professional football team cost an estimated $2.3 billion deal.

Investing Strategy: Deep Value Investor , Hedge Fund, Economics

1. Buy Cash Cheaper than Cash

David Tepper Quotes (19). Credit: www.Motivation2invest.com/David-Tepper

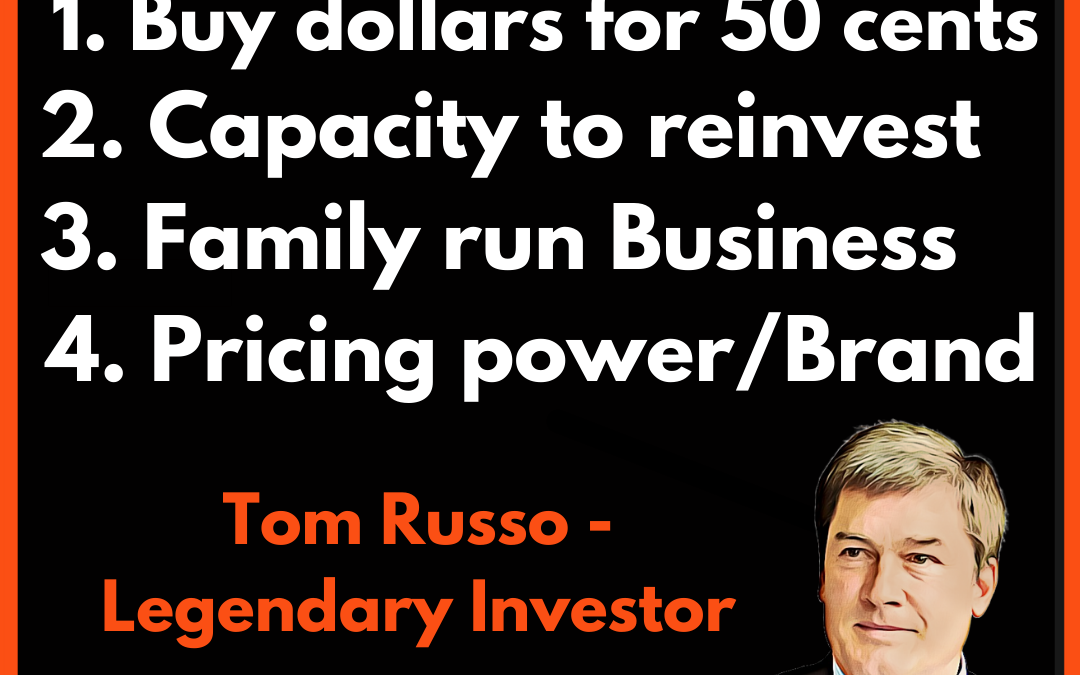

“It’s nice when you can buy cash, cheaper than cash” – David Tepper (Billionaire Investor) Investing is the process of investing money now with the goal of getting more back in the future. One method popular method of doing this to “Buy a dollar for 50 cents” or “Buy Cash Flows cheaply” as other Legendary Investors state.

This can be accomplished when the market has a mispricing on a stock thanks to the bad news, sentiment or just a different perspective.

Over time the Market realises that the 50 cents is actually worth $1 dollar and usually corrects to this price. Nobody knows when this correction will occur & usually a Catalyst is something great to look for in general.

2. Stay Humble

David Tepper Quotes (19). Credit: www.Motivation2invest.com/David-Tepper

“I was never afraid to go back to Pittsburgh and work in the steel mills” – David Tepper (Billionaire Investor) Tepper went to the University of Pittsburgh and worked at the Frick Fine Arts Library to cover the costs.

He achieved a Bachelors degree in Economics & began investing as a hobbyist during college. Tepper then when onto to business school before ending up at Goldman Sachs & then starting Appaloosa Management.

3. Keep Perspective

David Tepper Quotes (19). Credit: www.Motivation2invest.com/David-Tepper

“I’m just a regular upper middle class guy, who happens to a be a Billionaire” – David Tepper (Billionaire Investor) David Tepper was born into a Jewish Family the son of an Accountant & a School Teacher.

As a child he “ memorized baseball statistics given to him by his grandfather, this was early evidence of what Tepper claims is his photographic memory.” It wasn’t all easy for Tepper, In a 2018 commencement presentation at Carnegie Mellon University, David revealed that his father had been physically abusive toward him.

4. Don’t be Emotional when Investing

David Tepper Quotes (19). Credit: www.Motivation2invest.com/David-Tepper

“When it come to decisions I try not to be emotional, I drown out the noise & look at the important facts” – David Tepper (Legendary Investor)

5. Keep a Sense of Humour

David Tepper Quotes (19). Credit: www.Motivation2invest.com/David-Tepper

“After working on Wall Street you have a choice work at McDonalds or the Sell Side, I would Choose the first” – David Tepper (Billionaire Investor) In life it’s vastly important to keep perspective & a sense of humour no matter what your situation.

6. Live Frugal

David Tepper Quotes (19). Credit: www.Motivation2invest.com/David-Tepper

“I could buy an Island and a Private Jet, but instead I have Net Jets” – David Tepper (Billionaire Investor) The “net jets” is an Uber like service for wealth people to rent private Jets.

The idea is rather buying your own private jet, you can pay a yearly subscription and use the a private Jet as required. Warren Buffett & Tepper Tepper both famously invested into Net Jets.

7. Keep Your Cool

David Tepper Quotes (19). Credit: www.Motivation2invest.com/David-Tepper

“We keep our cool, when others don’t” – David Tepper (Billionaire Investor). Keeping a calm mind during times of crisis is a vital key for success.

Legendary Investor Carl Ichan has a favourite Poem (If by Rudyard Kipling) , One of the lines is “If you can keep your head while everyone else is losing theirs”

8. Wait for an Opportunity

David Tepper Quotes (19). Credit: www.Motivation2invest.com/David-Tepper

“The key is to wait, sometimes the hardest thing is to do nothing” – David Tepper (Billionaire Investor) Deciding not to act is still a decision. Warren Buffett often talks about “Waiting for the right pitch” and that there are “No called strikes” in Investing.

9. Everything Changes

David Tepper Quotes (19). Credit: www.Motivation2invest.com/David-Tepper

“Markets adapt, people adapt don’t listen to all the crap out there” – David Tepper (Billionaire Investor) When a crisis hits a company sometimes it feels like the world is going to end & recovery will not occur.

However, day always comes after night In the words of Billionaire Howard Marks “Most of the time the world doesn’t end…and if it does you will likely have bigger things to worry about” .

10. Know when it’s time to Make Money

David Tepper Quotes (19). Credit: www.Motivation2invest.com/David-Tepper

“There is a time to make money & a time not to lose money” – David Tepper (Billionaire Investor)

Know when it’s time to make money and when it’s time to play it safe. Surprisingly this is usually at the opposite times to most other people in the words of Warren Buffett: “Be Fearful when others are Greedy and Greedy when others are Fearful” .

Want to Learn how to invest?

If you want to learn how to invest like Warren Buffett but with a growth twist check out our: Investing Strategy Course Places on our strategy course & in our stock research platform are open for a limited time each month, so click the blue links above to find out more now.

David Tepper Quotes Gallery